The Ultimate Guide to Comparative Market Analysis CMA

A comparative market analysis (CMA) is the bedrock of any smart real estate decision. It’s an in-depth report that real estate agents put together to figure out a property's true market value. We do this by lining it up against similar homes that have recently sold in the same neighborhood.

This isn't just about pulling numbers; it's about creating a data-backed pricing blueprint. A solid CMA takes the guesswork out of the equation, giving sellers a competitive listing price and buyers the confidence to make a strong offer.

What Is a Comparative Market Analysis and Why It Matters

Think of a CMA as a scouting report for a house. Just like a coach studies the competition to map out a winning game plan, a real estate agent uses a CMA to strategically position a property for a fast, successful sale.

This report is far more than a simple history of local sales. It’s a professional assessment that delivers a recommended price range based on what’s happening in the market right now, grounding everyone's expectations in reality.

CMA vs. Formal Appraisal: What's the Difference?

People often mix up a CMA with a formal appraisal, but they're two different tools for two different jobs. An appraisal is a legally binding valuation done by a licensed appraiser, usually for a bank that needs to approve a mortgage. It’s a strict, backward-looking process that focuses almost entirely on sold properties.

A CMA, on the other hand, is a much more dynamic and strategic tool prepared by a real estate agent. It looks at the whole picture, including:

- Active Listings: The homes you're currently competing against.

- Expired Listings: A goldmine of information on what doesn't work, usually an over-inflated price.

- Pending Sales: The most up-to-the-minute pulse of the market, showing what buyers are willing to pay today.

A CMA gives you a real-time, strategic snapshot of the market. It’s less about checking a box for a lender and more about crafting a winning pricing and marketing strategy for a specific home.

The Importance in a Volatile Market

When the market is constantly changing, a CMA isn't just helpful—it's essential. It provides the hard evidence needed to justify a price, whether the market is heating up or cooling down.

Just look at the global picture. While residential property prices saw a slight dip of 0.8% year-over-year worldwide, the local stories are wildly different. Since early 2020, home prices in Turkey shot up by an incredible 112%, while in China, they dropped by 17%. These massive swings prove why a hyperlocal, data-driven CMA is the only way to get pricing right.

At the end of the day, a well-researched CMA is what allows an agent to advise their clients with total confidence. It ensures a home is priced perfectly to attract serious buyers without leaving a single dollar on the table. For a closer look at valuation methods, you can check out our guide on how to determine home value.

The Anatomy of a High-Impact CMA Report

A truly great Comparative Market Analysis is much more than a simple list of addresses and sale prices. Think of it as telling a story—the story of a home's value, backed by hard evidence. You're not just crunching numbers; you're building a compelling case for a specific price point.

To craft a report that earns a client's trust, you need to pull together a few key elements. Skip one, and you risk weakening your entire valuation, leaving your client with more questions than answers. It all starts with a deep, honest look at the property you're trying to price.

Profiling the Subject Property

Before you can even think about finding "comps," you have to know the subject property inside and out. This means going way beyond the basics like square footage or the number of bedrooms. You’re looking for the unique details that define its place in the market.

A solid property profile should capture:

- The vitals: Age, total square footage, lot size, and the bedroom/bathroom count.

- The standouts: Make a note of special features like a swimming pool, a three-car garage, a finished basement, or unique architectural details. These are your value-adds.

- The condition: How's the overall shape of the home? Have the kitchen and bathrooms been remodeled recently? Is the roof brand new? Every upgrade, big or small, plays a role in the final price.

- The location nuances: Where exactly is it? A quiet cul-de-sac is a world away from a busy main street. Does it back up to a park or have a great view?

When putting together a CMA, remember that value isn't just about what's inside the four walls. Things like these game-changing curb appeal ideas can dramatically boost a home's first impression and, ultimately, its market value.

To make sure you don't miss anything, it helps to use a checklist.

Essential Data Points for a Comprehensive CMA

Here’s a breakdown of the information you absolutely need to gather. Think of this table as your pre-flight checklist before you start searching for comps.

| Data Category | Key Information to Collect | Why It Matters |

|---|---|---|

| Property Basics | Address, age, square footage (above/below grade), lot size, number of bedrooms & bathrooms. | Forms the baseline for finding truly comparable properties. |

| Key Features & Amenities | Garage type (1/2/3 car, attached/detached), pool, fireplace, finished basement, central A/C. | These are the value drivers that differentiate one home from another and require specific adjustments. |

| Condition & Upgrades | Notes on recent remodels (kitchen, bath), roof age, HVAC system, flooring, overall state of repair. | A recently updated home will command a higher price than a similar one with dated finishes. |

| Location Specifics | School district, proximity to amenities (parks, shopping), street type (busy vs. quiet), view. | "Location, location, location" is a cliché for a reason. These factors have a major impact on desirability. |

| Listing History | Previous sale dates and prices, time on market from past listings. | Provides context on the property's past performance and market perception. |

By systematically collecting these details first, your search for comparables will be far more targeted and your final analysis much more accurate.

Gathering the Right Comparables

Once you have a crystal-clear picture of the subject property, it’s time to find your comps. This is the heart and soul of any CMA. You're looking for a balanced set of properties that paint a complete picture of the current market landscape.

A great CMA uses sold, active, and expired listings together. Sold comps show what the market has paid, active comps show your current competition, and expired comps show what the market has rejected.

You need to pull from three distinct categories:

- Recently Sold Properties: These are your gold standard. They provide undeniable proof of what buyers were actually willing to pay for similar homes in the last 3-6 months.

- Active Listings: This is your direct competition, right now. Looking at these homes helps you strategically position your client's property to win over today's buyers.

- Expired or Withdrawn Listings: Think of these as cautionary tales. They almost always point to an over-ambitious price tag and show you the ceiling of what the market is willing to accept.

Analyzing Key Market Trends

Finally, a CMA isn't complete without some context. The raw sales data is one thing, but it becomes much more powerful when you frame it with what's happening in the broader market. This step shows clients you understand the forces influencing their home's value.

Make sure you include these key trends:

- Average Days on Market (DOM): This tells you the pace of the market. A low DOM signals a hot seller's market, while a high DOM means buyers have the upper hand.

- List Price vs. Sale Price Ratio: This ratio reveals if homes are selling for, above, or below asking price. It’s a crucial indicator of how much negotiating power sellers currently have.

- Months of Inventory: This is your classic supply and demand metric. It shows how many months it would take to sell all current listings if no new ones came on the market.

By pulling together these three core pieces—a detailed property profile, a balanced set of comps, and sharp market analysis—you create a CMA that isn't just a number, but a well-reasoned, persuasive, and defensible valuation.

Performing a Manual CMA Step by Step

Putting together a comparative market analysis from scratch is a core skill for any real estate agent. It’s equal parts art and science, demanding a careful, methodical approach to land on a price that’s both accurate and easy to defend. This process is all about turning raw market data into a clear pricing strategy that your clients can actually understand and trust.

Think of it like building a puzzle. Every piece—from the details of the subject property to the final value adjustments—has to fit just right to show the true picture of the home's market value.

Let's walk through the manual steps to build a CMA that really works.

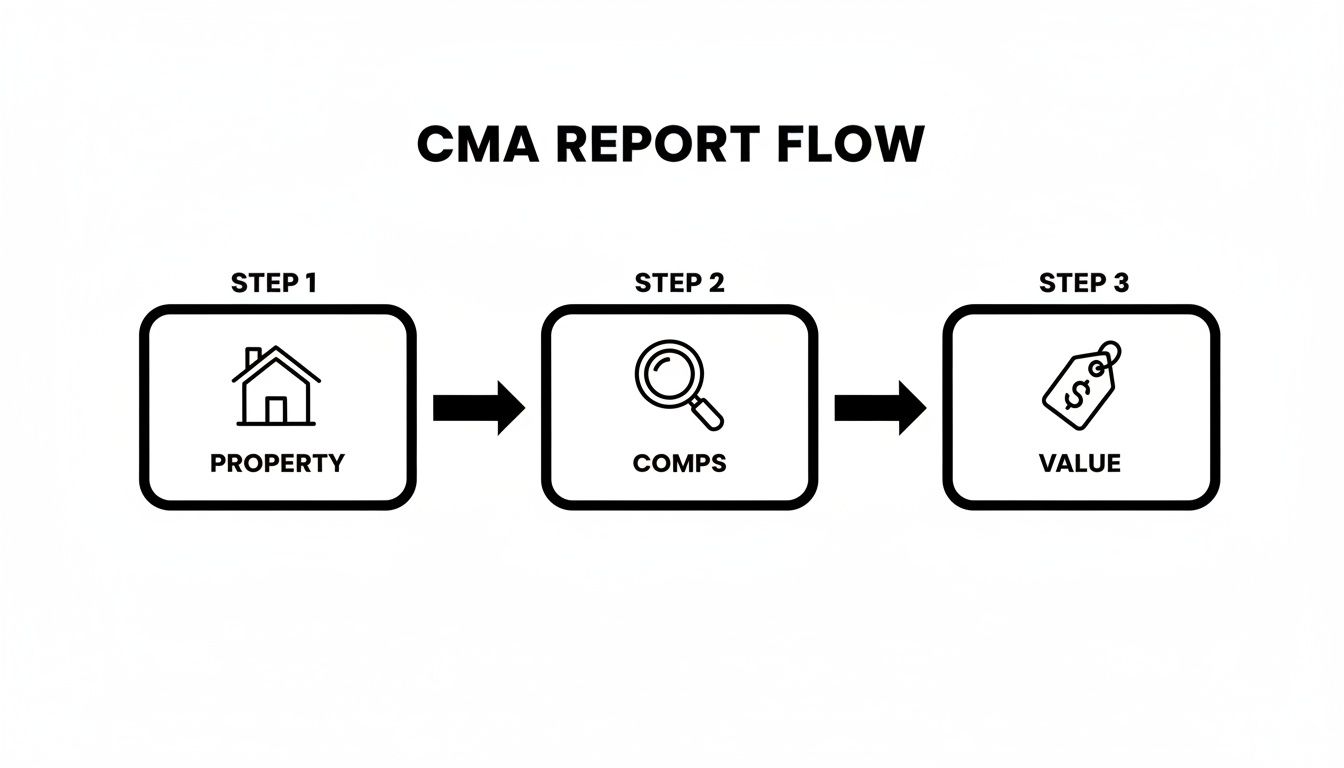

This simple workflow shows you the core process, from analyzing the property to figuring out the final value.

By moving through these three phases—evaluating the home, picking the right comps, and calculating the value—you create a report that’s logical and straightforward for your clients to follow.

Step 1: Define Your Search Criteria and Find Comps

The first, and most crucial, step is to lock down a precise set of criteria for finding the best comparable properties, or "comps." If your criteria are sloppy, your whole analysis will be weak. The goal here is simple: find homes a potential buyer would have seriously considered against the one you're pricing.

Start your MLS search with these core parameters:

- Location: Stick to the same subdivision or neighborhood first. If that doesn't give you enough to work with, expand to a half-mile radius, but be careful not to cross major lines like highways or school district boundaries that can dramatically alter property values.

- Recency: Zero in on properties sold within the last 3-6 months. In a fast-moving market, anything older is probably out of date.

- Size: Look for homes with a gross living area (GLA) within 10-15% of your subject property. So, for a 2,000 sq. ft. home, you'd be looking in the 1,800 to 2,200 sq. ft. range.

- Features: Ideally, the bed and bath count should be the same. Also, try to match key attributes like the home's style (e.g., ranch vs. colonial), garage size, and the size of the lot.

After your initial search, the objective is to whittle down that list to the 3 to 5 best comparables. These are the homes that are the closest match to your subject property and will need the fewest adjustments.

Step 2: Make Strategic Value Adjustments

No two homes are ever truly identical, and that’s where adjustments come into play. This is arguably the most nuanced part of the entire CMA process. You have to assign a credible dollar value to the differences between your subject property and each comp.

Let’s say you’re pricing a 3-bed, 2-bath home. One of your sold comps is almost a perfect match, but it only has 1.5 baths. To create a true apples-to-apples comparison, you need to "add" the value of that extra half-bath to the comp's sale price.

Here are a few common adjustments with typical values (which, of course, can vary a lot by market):

- Extra Half-Bath: +$3,000 to +$5,000

- Full Bathroom: +$5,000 to +$10,000

- Fireplace: +$1,500 to +$3,000

- Finished Basement (per sq. ft.): +$15 to +$35

- Updated Kitchen: +$10,000 to +$25,000

The rule for making adjustments is simple: If the comparable property is superior to your subject property in some way, you subtract value from its sale price. If the comparable is inferior, you add value to it.

Following this method ensures that every comp is weighed fairly. For a deeper dive into this valuation technique, check out our complete guide on the sales comparison approach.

Step 3: Calculate the Final Value Range

Once you've made adjustments for each of your comps, the final step is to calculate their adjusted sales prices. This just means taking the original sale price of each comp and applying your positive or negative adjustments.

Here's a quick example for a single comparable property:

| Feature | Subject Property | Comparable Property | Adjustment |

|---|---|---|---|

| Sale Price | - | $400,000 | - |

| Bedrooms | 4 | 4 | $0 |

| Bathrooms | 3 | 2.5 | +$5,000 |

| Kitchen | Updated | Original | +$15,000 |

| Adjusted Price | - | - | $420,000 |

You’ll repeat this process for all 3 to 5 of your chosen comps. When you're done, you'll have a list of adjusted prices—say, $420,000, $415,000, and $425,000.

From these adjusted values, you can pinpoint a final estimated market value. While you could take a simple average, it's often more accurate to give a little more weight to the comp that was most similar to begin with—the one that needed the fewest adjustments.

The result isn't a single magic number. It's a confident price range, something like $415,000 to $425,000. This data-backed range becomes the foundation of your pricing recommendation to your client, showing them you’ve done a thorough and professional analysis.

Common CMA Mistakes and How to Avoid Them

Even the most seasoned agents can make a misstep when putting together a CMA. These aren't just small errors; they can shake a client's confidence and completely throw off a pricing strategy. A trustworthy analysis is all about precision, and a few common blunders can sink it before you even present it.

Let's move past the generic advice. We're going to dig into the specific mistakes that can happen and, more importantly, how to sidestep them. The goal here is to craft a report that holds up under the toughest scrutiny—from your client, the agent on the other side of the deal, and even a professional appraiser. When you avoid these pitfalls, your recommended price isn't just a number; it's a solid, defensible conclusion backed by real market evidence.

Using Outdated or Irrelevant Comparables

This is, without a doubt, the biggest mistake you can make. Building your analysis on a weak foundation of bad comps is like trying to navigate a new city with a map from ten years ago. The landscape has changed. Using a home that sold eight months ago in a fast-moving market is just as useless. The same goes for picking a comp from across a major highway or in a completely different school district—those external factors are too different to make a fair comparison.

The Fix:

- Timeframe: Make your life easier and stick to properties sold within the last 90 days. If you absolutely have to, you can stretch it to six months, but you better be ready to explain why and adjust for any market shifts.

- Proximity: Stay hyper-local. Stick to the same subdivision or a tight radius (usually less than a mile) that shares the same schools, parks, and general vibe.

- Similarity: Look for the subject property's siblings—homes with a similar age, architectural style, square footage (within a 10-15% range), and the same number of beds and baths.

Making Inconsistent or Unrealistic Adjustments

Putting a dollar value on features can feel more like art than science, and that’s where things can get messy. If you give a $20,000 bump for an updated kitchen on one comp but only $10,000 on another without a good reason, it just looks sloppy. Even worse is giving way too much credit for minor upgrades while completely ignoring major flaws like a failing roof.

The Fix: Develop a go-to adjustment sheet for your market. Know what a bathroom remodel, a new kitchen, or a finished basement is actually worth at resale (which is different from its cost). When you apply consistent, logical values across all your comps, your professionalism shines through, and your final price becomes much easier to defend.

A common pitfall is treating all data as equal. The story isn't just in the numbers themselves, but in the context you provide. Presenting a raw data dump without a clear narrative will confuse your clients and weaken your position as a market expert.

Ignoring Market Momentum and Concessions

A CMA isn't just a static picture of the past; it needs to reflect where the market is headed. Is inventory shrinking and are homes flying off the market faster each month? If so, pricing based only on last quarter's sales might mean leaving money on the table. On the flip side, if inventory is piling up, you can't ignore that, or you’ll end up with an overpriced listing that just sits there.

Another detail that's easy to miss is seller concessions. That comp that "sold" for $450,000? Well, if the seller kicked in $10,000 for the buyer's closing costs, the real sale price was $440,000. If you don't account for that, you're inflating your valuation and setting your client up for disappointment.

When you're meticulous about picking fresh comps, applying logical adjustments, and tuning into the market's subtle signals, your CMA becomes more than just a report. It transforms into a powerful tool that helps you win listings and get them sold.

How AI Is Revolutionizing the CMA Process

Let's be honest: the days of blocking off half your morning to pull comps and wrestle with spreadsheets are numbered. While a manual comparative market analysis is still a fundamental skill, today's technology offers a much smarter and faster way to get the job done. AI-powered platforms are completely changing the game for agents, transforming one of their most time-consuming tasks into something that takes mere seconds.

Imagine this: you take the entire CMA workflow—from digging up data to generating a beautiful, client-ready report—and shrink it down to a task that takes about 30 seconds. That's not science fiction; it's the reality of artificial intelligence. These systems aren't just about speed; they deliver a more thorough analysis, giving you a serious edge in a market where both speed and accuracy win listings.

From Hours of Data Entry to Instant Analysis

The biggest headache with a traditional CMA has always been the manual labor. Agents spend hours clicking through the MLS, searching county records, and painstakingly copying property details into a template. That administrative grind doesn't just eat up valuable time you could be spending with clients; it’s also ripe for human error.

AI platforms cut right through that bottleneck. They tap directly into live data sources, including:

- Multiple Listing Services (MLS): Instantly grabbing the latest sold, active, and pending listings.

- Public Records: Pulling tax assessments, property history, and ownership details automatically.

- Market Trend Data: Sifting through millions of data points to get a read on a neighborhood's pricing momentum.

This automated approach means the information is always fresh and complete, creating a rock-solid foundation for your analysis. Instead of manually searching for comps, you just type in an address.

This example from Saleswise shows just how simple it is. An agent can kick off a full CMA with a single click after entering the property address. The platform then presents a clear, data-rich report, highlighting the massive shift from manual grunt work to automated intelligence.

Unlocking Unmatched Speed and Accuracy

Once the data is in, AI algorithms get to work. They analyze dozens of variables at once—square footage, lot size, age, condition, specific features, and recent renovations—to pinpoint the most relevant comps with incredible precision.

But the real magic happens with the adjustments. Manually, we often rely on our best guess to value a finished basement or a brand-new kitchen. AI, on the other hand, uses sophisticated models trained on massive datasets to calculate these adjustments. The result is a valuation that's more objective, consistent, and easier to defend, removing a lot of the unintentional bias that can creep into a manual analysis.

The core benefit of an AI-driven CMA is its ability to process hundreds of data points that a manual analysis often misses. This leads to a valuation that is not only faster but also statistically more robust, giving both you and your clients greater confidence in the recommended price.

The demand for these kinds of efficient, data-backed tools is only growing, especially as the global real estate market is projected to hit USD 7.03 trillion by 2034. A market that massive relies on accurate valuations, and platforms like Saleswise are built to meet this need by producing detailed reports almost instantly. You can explore this trend further and see the full real estate market projections.

Generating Client-Ready Reports in Seconds

The final piece of the puzzle is presentation. A good AI platform doesn’t just throw raw numbers at you. It assembles everything into a professional, visually engaging report that’s ready to share with your client. Think maps, photos of the comps, graphs showing market trends, and a clear summary of the final valuation range.

This instant report generation lets you be incredibly responsive. When a potential seller calls, you can have a complete, persuasive CMA in their inbox before you even hang up the phone. That kind of service builds immediate credibility and can absolutely be the thing that wins you the listing. If you want to dive deeper into how artificial intelligence is changing the industry, you can learn about some of the best AI tools for real estate agents.

By automating the most tedious parts of creating a CMA, AI frees you up to focus on what you do best: building relationships, providing expert advice, and closing deals. If you're ready to make the switch, take a look at our guide on the top options for real estate CMA software.

Presenting Your CMA to Win the Listing

All the work you put into a CMA comes down to this moment. A truly accurate market analysis is an incredible tool, but its real power is unleashed in how you present it. This is where you go from analyst to advisor, turning a stack of data into a compelling story that builds unshakable trust.

Your mission isn't just to hand over a report; it's to start a conversation. You need to guide your clients through the information, connecting every number and every comp directly to their goals. You're the expert interpreter, translating complex market signals into a clear, actionable pricing strategy that makes sense to them.

Crafting a Clear Narrative

Never lead with the final price. That’s a rookie mistake. Instead, you need to set the stage. Start with a snapshot of what’s happening in their immediate local market. Are homes flying off the shelf, or are they sitting for a while? What's the average list-to-sale price ratio? This context is crucial because it helps sellers understand the real-world environment their property is about to enter.

From there, walk them through the comparable properties you hand-picked. Make it visual. Use a map to show them where the comps are located in relation to their own home. Go through the photos. Explain exactly why each one matters to their sale.

- Sold Comps: These are your proof. Frame them as the undeniable reality of what buyers are willing to pay for a similar home, right here, right now.

- Active Comps: This is your direct competition. Discuss how their home stacks up and what you need to do to make it stand out from these other listings.

- Expired Comps: Treat these as powerful cautionary tales. They're the perfect illustration of what happens when a home is overpriced from the start.

This storytelling approach makes the data digestible and justifies your final price recommendation before you even have to say the number.

Justifying Adjustments and Setting the Price

When you get to the adjustments, drop the industry jargon. Nobody cares about a "negative adjustment for a superior lot." Instead, make it relatable. "This home down the street sold for a bit more because it backs onto that beautiful park. Since we don't have that feature, we need to account for that difference in our pricing." Simple, clear, and logical.

Finally, present your valuation as a strategic price range, not a single, immovable figure. This simple shift changes the entire dynamic. It invites the seller into the conversation and makes them an active partner in the decision. It's their home, after all.

The global housing market is constantly shifting, and a documented shortage across many economies has fueled an ongoing affordability crisis. These dynamics make a precise comparative market analysis absolutely essential for helping clients understand their position. You can dive deeper into these global housing trends and their impact to add even more context to your client conversations.

A winning CMA presentation is less about showing how much work you did and more about demonstrating how your work helps the client achieve their goals. It’s a conversation that builds confidence and secures the partnership.

By framing your CMA as a clear, logical story, you transform your role from a simple data-gatherer to a trusted advisor. This approach doesn't just validate your pricing strategy—it solidifies your value and makes you the obvious choice to sell their home.

Common CMA Questions (and Answers for Your Clients)

Even after walking a client through a detailed CMA, they'll almost always have a few questions. That's a good thing—it means they're engaged. Being ready with clear, confident answers is key to building trust and showing you know your stuff.

Here are some of the most common questions that pop up, along with simple ways to explain them.

How Is a CMA Different From an Appraisal?

This one comes up all the time. It's easy to see why people get them mixed up, since both have to do with a home's value. But they serve very different purposes.

Here's how I explain it:

- A CMA is a pricing strategy tool. As your agent, I create it to figure out the best possible list price to attract buyers right now. It's about looking at the current competition and market trends to position your home to sell.

- An appraisal is a formal valuation. It’s done by a licensed appraiser, usually hired by the buyer's bank, to make sure the property is worth the loan amount. They follow a much stricter, backward-looking process that focuses almost entirely on past sales.

Think of it like this: My CMA helps us answer, "What should we list this home for to get it sold in today's market?" An appraisal answers the bank's question: "What is the official value of this property for the mortgage?"

How Many Comps Do You Need for a Good CMA?

There isn’t a single magic number, but the sweet spot is usually between three and five really solid comparable properties. The key here is quality, not quantity.

I’d much rather build a pricing strategy on three homes that are almost identical to yours and sold last week than use ten mediocre comps that are older, in a different school district, or need a ton of adjustments. A tight, well-chosen set of three to five comps gives us a reliable and easy-to-defend price without drowning you in data.

Can I Just Do My Own CMA Online?

It's tempting, for sure. Homeowners can see public records and play around with online estimators, but a true CMA digs much deeper. The real analysis requires access to the Multiple Listing Service (MLS), which is a treasure trove of data the public can't see.

That’s where we find crucial details like how much the seller contributed to closing costs, how many times the price was dropped, and the final terms of the deal. Beyond the data, an experienced agent brings a feel for the market—the "art" behind the science—that no algorithm can replicate. We see the nuances that automated tools miss.

How Long Is a CMA Good For?

A CMA is a snapshot of the market at a very specific moment, and in real estate, things can change in a hurry. As a general rule, a CMA is really only reliable for about 30 days.

If a home sits on the market for longer than a month, it's time for a refresh. New properties have sold, other listings have had price changes, and the overall market mood might have shifted. Keeping the CMA current ensures our pricing strategy never gets stale and always reflects what’s happening right now.

Ready to create stunning, accurate CMAs in seconds? With Saleswise, you can generate professional, client-ready reports instantly, freeing you up to focus on winning listings and closing deals. Start your $1 trial of Saleswise today.