Your Guide to a Winning Comparative Market Analysis Template

A custom comparative market analysis template is your secret weapon. It’s what separates you from the agent who just prints a generic report and slides it across the table. This isn't just about data; it's about turning that data into a compelling story that builds trust and proves you know your stuff. It’s the difference between being a facilitator and being a trusted advisor who wins the listing.

Why Your Custom CMA Template Is a Game Changer

Let's be real—the standard report that your MLS spits out isn't designed to impress anyone. Sure, it has the numbers, but it’s a data dump. It has zero personality, no clear narrative, and it certainly doesn't scream "top-tier agent." A custom CMA template is your chance to break free from that sea of sameness right from the first handshake.

This is your primary consultation tool. A personalized, well-designed CMA shows you're meticulous and that you’ve put real thought into your client’s specific situation. It takes a simple valuation and elevates it into a powerful, brand-defining moment.

Beyond Data: A Branded Experience

When you walk into a listing presentation with a custom CMA, you’re doing more than just talking numbers—you're showcasing your brand. Everything from the layout and your logo to the specific details you choose to highlight sends a message about your professionalism. It’s your first opportunity to manage client expectations and set the tone.

A thoughtfully crafted template helps you:

- Establish Authority: You’re in control of the conversation, guiding clients through your reasoning instead of leaving them to get lost in a spreadsheet.

- Build Trust: A clean, easy-to-follow report shows you’re transparent and committed to an honest partnership from day one.

- Differentiate Your Service: While your competitors are using automated, cookie-cutter tools, you’re delivering a bespoke analysis. That personalized touch is something they just can't replicate.

A great CMA doesn't just suggest a price; it tells a story about the market, the property's place in it, and the strategy for a successful sale. It’s your best tool for educating your clients right from the start.

Navigating Complex Market Dynamics

The market is always in motion. Local and even global trends can create a tricky environment that demands sharp, clear analysis. Your custom template is the perfect way to translate those high-level dynamics into practical advice for your clients.

Consider how much things can change. The 2025 global real estate landscape, for example, is already showing major differences between sectors. To make sense of it all, you need a CMA template that can weave in transaction surges, supply gaps, and hard numbers. Globally, transaction volumes recently hit $739 billion in a trailing year, a 19% increase—that’s a huge shift. Staying on top of these global real estate trends helps you explain the "why" behind your pricing.

The Practical Advantage in Real-World Scenarios

Picture this. An agent hands a seller a 20-page, text-heavy report from the MLS. The seller's eyes glaze over. They're overwhelmed by jargon and have no clue how the agent landed on that suggested price.

Now, imagine you walk in with your custom CMA. It’s visually appealing, with great photos, a clear map of the comps, and a simple adjustment grid. You walk them through it, explaining why you adjusted one comp down for being on a busy street and another up for its brand-new kitchen. The seller gets it. They feel informed, confident in you, and fully on board with the pricing strategy.

Which agent wins the listing? It’s not even a contest. Your template is the bridge between raw data and client confidence. It’s the tool that proves you’re not just another agent—you’re a true market expert.

Sourcing the Right Data for Your Analysis

A killer CMA template is useless without the right data. Honestly, the entire analysis—from your final price recommendation to the market insights you share—is built on the quality of the information you gather. Think of it less like a quick MLS search and more like a strategic intelligence mission. Get this part right, and you've set the stage for a valuation your clients will trust.

There's an old saying: garbage in, garbage out. It’s a cliché for a reason, and it’s especially true here. If you use outdated comps, gloss over important property details, or misread the local market trends, your analysis will be flawed. That’s a fast way to lose a client's trust and potentially cost them a lot of money. The mission is to build a complete, 360-degree view of the subject property and its immediate market environment.

That means your first stop isn’t the MLS. It’s the property you’re actually trying to price. Before you even think about looking for comps, you have to know the home you're evaluating inside and out.

Start with the Subject Property

Your entire analysis begins at home—literally. A deep dive into the subject property is what gives you the baseline for everything else. You can't just take the owner's word for it; you need to verify every single detail yourself through official records and a thorough walkthrough.

Here's a quick checklist of what I always pull for the subject property:

- Public and Tax Records: First thing I do is pull the tax records. I'm looking to confirm the legal owner, the assessed value, lot size, and most importantly, the official square footage. It's amazing how often what the owner thinks they have differs from public records.

- Deed Information: Next, I check the deed. I’m hunting for any easements, covenants, or restrictions that could affect its value. Things like a shared driveway or a conservation easement are critical details you can't afford to miss.

- Property History: A quick search on the MLS will show you the property's sales and listing history. Knowing when it last sold, for how much, and if it ever sat on the market unsold gives you invaluable context.

- Unique Selling Points: This is where your eyes on the ground matter most. During the walkthrough, I document everything that makes the property stand out. How old is the HVAC? What's the condition of the roof? Is that kitchen remodel a high-end job or a quick flip? These are the details that justify your adjustments later.

Remember, every piece of information you gather here acts as a filter for finding the best comps. Without a crystal-clear picture of what you're valuing, you're just comparing apples to oranges.

Selecting the Best Comparable Properties

Okay, now that you have a detailed profile of the subject property, you can start the real art of the CMA: selecting the comps. This is where your expertise and market knowledge really come into play. The goal is simple: find properties that are as similar to yours as possible. This creates a logical and defensible basis for your valuation.

I always stick to what I call the "golden rules" for picking comps. Think of them as a series of filters, starting with the most important factors first.

The Golden Rules of Comps

- Proximity: Closer is always better. Start your search in the exact same subdivision or, at most, within a quarter-mile radius. If you're in a rural area, you might have to stretch that to a mile or more, but the principle is the same: hyper-local data is king.

- Sale Date: Recency is everything. I prioritize homes sold within the last 90 days. In a fast-moving market, a sale from six months ago might as well be from a different lifetime.

- Size and Layout: Look for homes with a similar bed/bath count and a comparable gross living area (GLA). A good rule of thumb is to stay within a 10-15% variance on square footage.

- Age and Condition: You can't compare a brand-new build to a 50-year-old fixer-upper and expect an accurate result. Try to match the home's age, architectural style (like a colonial vs. a ranch), and its overall condition.

But the real magic happens when you dig deeper than these basic rules. This is what separates a professional CMA from an automated Zillow estimate. A comp might have the same square footage but back up to a busy road, which absolutely kills its value. Another might have a premium corner lot with a great view, justifying a much higher price.

These are the qualitative insights that make your analysis truly valuable. Documenting these subtle differences is exactly what will allow you to make credible, well-supported price adjustments down the line.

Designing Your Template Section by Section

Once you've got all your data, it's time to stop gathering intel and start building your actual presentation. This is where your custom comparative market analysis template really starts to shine. Anyone can spit out a generic report full of numbers. A thoughtfully designed CMA, however, tells a story—one that guides your client toward the right pricing decision with total confidence.

Let's walk through how to build out each crucial part of your template. The whole point is to create a professional, easy-to-follow document that makes your findings crystal clear. We'll structure it section by section to build a powerful and persuasive narrative.

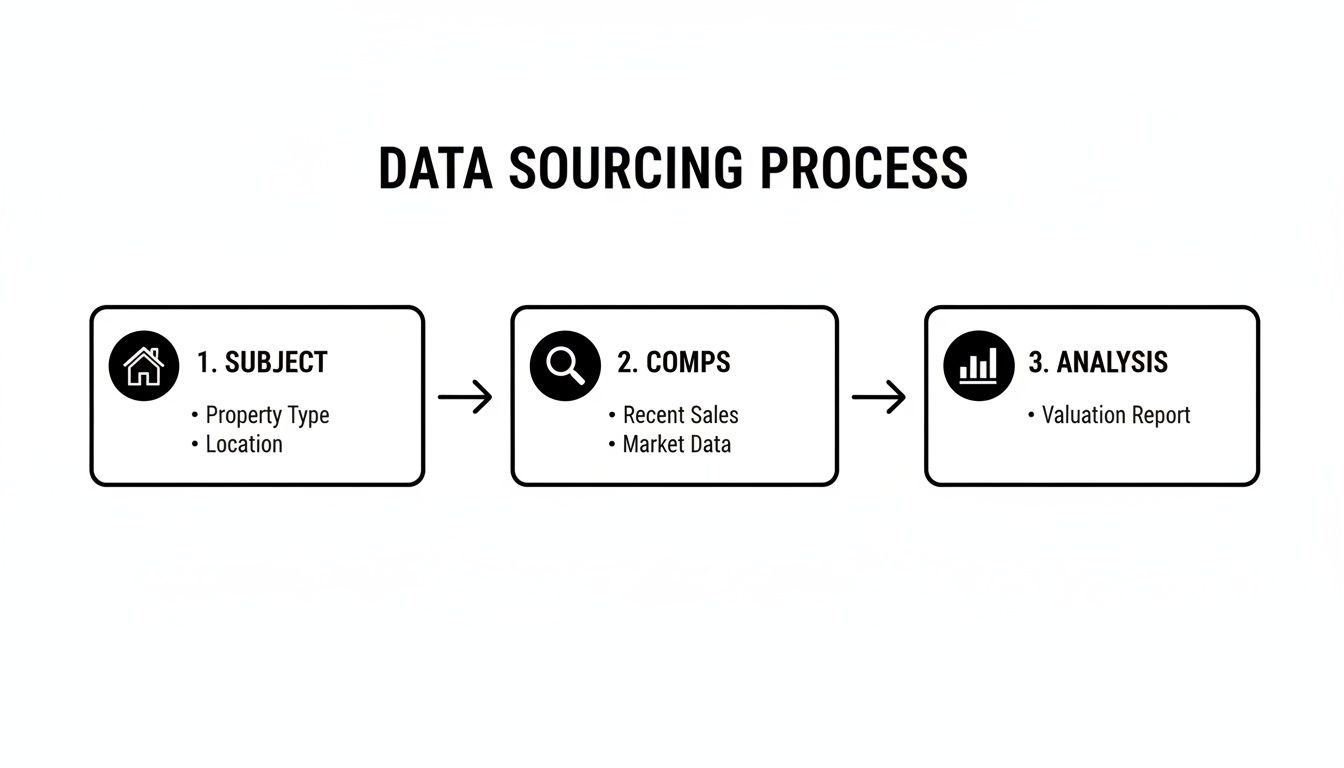

Remember, everything you build in the template rests on the quality of your data sourcing, which flows from understanding the subject property, to finding the right comps, and finally, to your analysis.

As you can see, a solid analysis is impossible if you haven't first done a deep dive on the subject property and then found truly comparable sales to measure it against.

Laying the Foundation with Essential Data

Before you even start designing the layout, you need a checklist of all the information you're going to plug in. A well-organized CMA is built on a solid foundation of data points for both the seller's home and the comparable properties. Getting this right from the start saves a ton of headaches later.

Here’s a quick rundown of the critical data you should always gather.

Essential Data Points for Your CMA

| Data Category | Subject Property Details | Comparable Property Details | Primary Source or Tool |

|---|---|---|---|

| Basic Info | Full address, square footage, bed/bath count, lot size, year built | Same details as subject | MLS, Public Records (Tax Assessor) |

| Listing History | Previous list/sale dates and prices | List/sale dates, days on market (DOM), original vs. final price | MLS History |

| Financials | Annual property tax amount | Final sale price, concessions (if any) | Public Records, MLS Closed Data |

| Condition/Features | List of specific upgrades (e.g., "New roof 2023"), unique features, overall condition | Notes on condition from photos/descriptions (e.g., "dated kitchen," "updated master bath") | Seller Interview, MLS Photos/Descriptions |

| Visuals | High-quality photos (exterior and key interior rooms) | Main MLS listing photos | Your Own Photos, MLS |

Having this checklist ensures you don't miss anything important and that your final report feels comprehensive and professional, not slapped together.

The Subject Property Overview

This first section sets the stage for the entire analysis. Think of it less like a data sheet and more like a professional profile of your client's home. It’s your first real chance to show them you’ve paid close attention to what makes their property special.

Always start with a high-quality, cover-worthy photo of the home. This simple touch makes the report feel personal right from the get-go. Then, follow it up with a clean, organized summary of the home's core details.

Your summary should absolutely include:

- Property Address: Stated clearly at the very top.

- Key Specifications: The essentials—square footage, bed/bath count, lot size, and the year it was built.

- Public Record Data: Drop in the parcel ID and the most recent tax assessment info.

- Unique Features & Upgrades: This is your spot to shine. Create a dedicated space to list standout items like "New Roof (2023)," "Remodeled Kitchen with Quartz Countertops," or "Finished Basement with Egress Window."

Think of this section as the "hero" of your report. By highlighting the property's best attributes upfront, you validate the seller's pride in their home and establish a strong baseline before you even introduce the comparables.

Detailed Comparable Property Profiles

Now it's time to introduce the supporting cast: the comparable properties. Please, don't just list a bunch of addresses and prices. Each comp deserves its own profile page, like a mini-dossier that gives the client some much-needed context. This is where you justify why you chose each property.

For every comparable—sold, active, and expired—use a consistent layout. This repetition is key, as it makes the information much easier for your client to scan and compare.

A solid comp profile always has:

- A Primary Photo: The main MLS photo usually works best.

- Status and Dates: Clearly label it as SOLD, ACTIVE, or EXPIRED. Be sure to include the sale date (or list date) and the days on market (DOM).

- Core Specs: Bed, bath, square footage, and year built.

- Sale and List Price: Show both the original list price and the final sale price. Calculating the list-to-sale price ratio is a really powerful metric to include here.

- Your Expert Notes: This is your space for commentary. For instance: "This property is a strong comp due to its similar floor plan but lacks the updated kitchen of your home. It sold in just 14 days, indicating strong demand for this layout."

This level of detail proves you've done more than just pull a list; you've critically evaluated each property. If you're looking to speed up this part of the process, exploring different types of real estate market analysis software can introduce you to tools that automate pulling all this data together, giving you more time to actually analyze it.

The Side-by-Side Comparison Grid

This is the heart of your CMA. It's where all the data comes together in a single, powerful visual. A well-designed comparison grid lets you and your client see the entire market picture at a glance. Your MLS probably generates a basic version, but a custom one in your template is far more effective.

The grid should be a simple, clean table. The first column lists the features, and the following columns are dedicated to the subject property and each of your comps.

| Feature | Subject Property | Comp 1 (Sold) | Comp 2 (Sold) | Comp 3 (Active) |

|---|---|---|---|---|

| Sale Price | TBD | $515,000 | $495,000 | $525,000 (List) |

| Sale Date | N/A | Oct 15, 2024 | Sep 28, 2024 | Currently Listed |

| Days on Market | N/A | 14 | 32 | 8 |

| Square Footage | 2,150 | 2,100 | 2,200 | 2,125 |

| Bedrooms | 4 | 4 | 4 | 4 |

| Bathrooms | 2.5 | 2.5 | 2.0 | 2.5 |

| Garage | 2-Car | 2-Car | 2-Car | 2-Car |

| Condition | Updated | Good | Dated | Updated |

| Notes | New Kitchen | Original Cabinets | Needs Roof | Similar Updates |

This visual format makes it incredibly easy to spot the key differences that will eventually require price adjustments.

The Price Adjustments Section

Finally, you need a section that clearly explains your price adjustments. This is where you translate the differences you noted in the grid into actual dollar amounts. Transparency here is non-negotiable; it’s what builds a client’s trust in your final price recommendation.

Don’t just show the math—frame it with a brief explanation. For example, if a comp has one less bathroom, your adjustment section should look something like this:

- Comp 2 - Bathroom Count: This property has only 2.0 bathrooms compared to your home's 2.5. Based on recent sales in this neighborhood, a half-bath adds approximately +$7,500 in value.

When you break down each adjustment this way, you demystify the entire valuation process. The client can follow your logic step-by-step and see exactly how you landed on the suggested market value. This methodical approach transforms your CMA from a simple document into a masterclass in market valuation, solidifying your role as the trusted expert.

Mastering the Art of Price Adjustments

Pulling comps is the science, but making the right adjustments? That’s where the art comes in. This is the moment your expertise as an agent truly shines, turning a spreadsheet of data into a confident, defensible valuation for your client. We're moving beyond simple math and into the nuanced process of justifying every single dollar.

The goal isn't to force the numbers to fit a price you already have in mind. It's about logically and transparently accounting for the differences between your client's property and the comps you've selected. A great set of adjustments tells a clear story, showing a client exactly how you landed on your recommended price.

Valuing Tangible Property Features

Let's start with the most straightforward adjustments—the physical differences between properties. These are the things your clients can see and touch, so assigning a credible dollar value to them is absolutely critical for building trust. The key is to have a consistent, logical framework for how you calculate them.

Take square footage, one of the most common adjustments. You can't just pull a generic, city-wide price per square foot and call it a day. A much more accurate figure comes directly from your selected comps. If a few similar homes in that specific neighborhood sold for an average of $250 per square foot, that becomes your baseline for adjusting comps that are larger or smaller.

Beyond the overall size, you need a method for valuing other key features:

- Bedrooms and Bathrooms: A full bathroom might consistently add $10,000 in your market, while a half-bath is closer to $5,000. These aren't just guesses; they should be based on paired sales analysis—finding two nearly identical homes where the only significant difference was the bathroom count.

- Lot Size and Location: A desirable corner lot might command a $15,000 premium. In contrast, a property backing onto a noisy main road could warrant a -$20,000 adjustment to a comparable.

- Specific Amenities: Things like a swimming pool, a professionally finished basement, or a three-car garage all have real value. Look at recent sales of homes with and without these features to figure out a realistic adjustment amount.

The core principle here is defensibility. For every single adjustment you make, you need to be able to answer the question, "How did you get that number?" with a logical, market-based explanation.

Accounting for Intangible Market Forces

This is where many agents drop the ball. A truly professional CMA looks past the spec sheet and considers the invisible forces shaping the market right now. These factors won't show up in a property's public description, but they have a massive impact on its final sale price.

Your CMA template should have a dedicated section for analyzing these trends. It immediately shows the client you aren't just comparing houses; you're interpreting the market's pulse.

Key Market Indicators to Analyze

Think about how the current market dynamics are influencing value. For example, the absorption rate—how quickly available homes are being sold—is a powerful indicator. A low absorption rate (a strong seller's market) might mean you make smaller negative adjustments for a comp's flaws, simply because buyers are more forgiving when inventory is tight.

Here are other critical intangibles you have to factor in:

- Days on Market (DOM): If your comps all sold in under 10 days, it signals a hot market where properties are likely selling at or above the asking price. A comp that sat for 90 days before selling tells a completely different story about buyer demand, even if the final price was similar.

- List-to-Sale Price Ratio: A ratio of 102% across your comps means homes are consistently selling for more than they're listed for. This trend could justify pricing your client's property a bit more aggressively from the start.

- Seller Concessions: Did a comparable sale include $10,000 in seller-paid closing costs? If so, the true sale price was effectively $10,000 lower than the number on the public record. Failing to adjust for this gives you an inflated, inaccurate view of that comp's value.

For a deeper dive into how these factors play into a property's final valuation, you can learn more about the sales comparison approach and how professionals weigh these complex variables.

By weaving these intangible forces into your analysis, you provide a far more accurate and insightful valuation. It demonstrates a sophisticated understanding of the market that goes miles beyond what any automated valuation tool can offer. Your final price won't just be a number; it will be a well-supported conclusion based on a complete picture of the market.

How to Present Your CMA for Maximum Impact

You can put hours into building the perfect comparative market analysis, but if the delivery falls flat, so will your chances of winning the listing. This final step is critical. It’s where you transform your data-driven document into a persuasive conversation that wins your client’s trust. You’re not just reading numbers off a page; you’re telling a story that guides them to the right conclusion with confidence.

Think of your presentation as a visual narrative. Use professional, high-quality photos of the subject property and the comps you’ve selected. A clear, easy-to-read map showing the proximity of the comparable properties is a must—it instantly validates your choices. Simple charts and graphs are also your best friend for making complex data, like pricing trends or days-on-market stats, easy for anyone to grasp. If you need a little inspiration, check out these presentation design ideas to make your CMA truly pop.

A visual summary like this is powerful because it boils down a ton of information into a format clients can scan and understand in seconds. It’s all about clarity and building a solid case.

Build a Narrative Around the Numbers

Don't just dump data on your clients. You need to interpret it for them. Walk them through the story of how you arrived at your pricing recommendation. Start by highlighting the subject property's best features, then introduce the comparable properties one by one, explaining why you chose them and how they stack up.

From there, connect the dots to your final pricing strategy. Always frame your analysis within the context of what’s happening in the market right now. For instance, are interest rates impacting buyer demand? Is local inventory tight? A well-crafted CMA should give you a platform to discuss these broader market forces and show you’re not just a real estate agent, but a true market advisor.

Anticipate Questions and Handle Objections

A truly great presentation answers questions before they’re even asked. You know the common concerns and objections that come up, so be ready to tackle them with data and confidence.

- "Why is my neighbor's house priced higher?" This is a classic. Have the details of that specific listing on hand. Be ready to explain the key differences—maybe their home has a brand-new kitchen, a finished basement, or a more private backyard that justifies the price gap.

- "Can't we just list it higher to 'test the market'?" This is where your expired comps become your secret weapon. Show them hard evidence of what the market has already rejected at that price point. Explain how overpricing often leads to the property sitting on the market, getting stale, and ultimately selling for less.

- "What about the Zestimate?" Acknowledge that online estimates are a popular starting point, but gently explain their limitations. Point out the specific, nuanced adjustments you made—for things like the condition of the roof or the home's unique curb appeal—that an algorithm simply can't account for.

For more tips on building a report that proactively answers these tough questions, take a look at our guide on creating a free comparative market analysis.

Your CMA presentation is your audition. It’s the moment you stop being just another agent and become their trusted, indispensable expert. Deliver it with clarity and a compelling story, and you won’t just be suggesting a price—you’ll be winning the listing.

A Few Common CMA Questions

Even with a killer template, you're going to have questions when you're actually in the weeds building a CMA. Putting one of these together is part science, part art, and knowing how to handle the tricky spots can make all the difference.

Let's walk through some of the questions that come up time and time again. Getting these right turns a good CMA into a great one and helps you show your clients you truly know your stuff.

How Many Comps Should I Really Use?

Ah, the classic question. There's no magic number, but there is a magic formula. You're trying to tell the most accurate, honest story about the market for that specific home, and a skewed selection of comps will tell the wrong story.

For a really solid, defensible analysis, I always aim for this mix:

- 3-5 Recently Sold Properties: This is your foundation. These are the non-negotiable facts—what buyers have actually paid for similar homes nearby.

- 2-3 Active Listings: This is your current competition. These comps show the seller exactly who they're up against right now and are crucial for positioning the home to sell.

- 1-2 Expired or Withdrawn Listings: Think of these as cautionary tales. They're powerful proof of what the market has already rejected at a certain price, which is incredibly useful for managing a seller's expectations.

This blend of past performance, present competition, and past failures gives you a much richer, more compelling narrative than just a simple list of sold homes ever could.

Should I Use Software or a Manual Template?

Honestly, the best approach is a bit of both. Don't frame it as an "either/or" situation. Think of it as using the right tool for the right part of the job. CMA software is a phenomenal time-saver for pulling the raw data quickly. It can churn out a list of potential comps in minutes.

But here's the catch: if you just hit "print" on that software-generated report, you're giving your client the same generic document every other agent is.

Your real value—your secret sauce—is using your custom comparative market analysis template to interpret, analyze, and add your own expertise to the data. When you build your own template, you understand what every single piece means, which forces you to think critically about the numbers the software spits out.

What Is a Defensible Way to Value Adjustments?

Consistency is king. You need a logical, repeatable reason for every single adjustment you make, whether you're adding or subtracting value. The gold standard here is what appraisers call "paired sales analysis." Basically, you find two comps that are almost identical except for one major feature—say, one has a pool and the other doesn't. The difference in their sale price is a pretty defensible market value for that pool.

When it comes to things like square footage, don't use a generic city-wide number. Calculate a hyper-local price-per-square-foot based only on your most relevant comps. Most importantly, document your thought process right there in the CMA. You need to be able to walk your client through your logic with complete confidence.

How Often Should I Update a CMA?

A CMA is a snapshot in time. If your client hasn't decided to list within two to four weeks, you absolutely have to go back and refresh the data. The market can change on a dime.

In a really hot market, you might even need to check in weekly. A new home hitting the market, a competitor going under contract, or a sudden price drop can completely change the pricing strategy. Showing up with old data is a surefire way to lose credibility and misprice a home.

Ready to create accurate, client-ready CMAs in seconds, not hours? Saleswise uses AI to research comps and generate detailed reports instantly, giving you back valuable time to focus on your clients.