A Modern Agent's Guide to CMA Real Estate Success

A CMA, or Comparative Market Analysis, is a real estate agent's secret weapon for pricing a home. It's an in-depth report that helps pinpoint a property's true market value by comparing it to similar homes that have recently sold nearby.

What Is a Real Estate CMA and Why Does It Matter

Think of a CMA less as a report and more as the story of a home's value. It’s not just a collection of addresses and prices; it’s a strategic analysis that shows exactly where a property fits into the current, living market. At its heart, the CMA is about taking the guesswork out of pricing.

A truly well-crafted CMA is the first, and arguably most important, step in building trust with a seller. It’s your chance to demonstrate real expertise, back up your pricing recommendations with hard data, and show them you know what it takes to get their home sold. When a seller sees the logic behind the numbers, their confidence in you skyrockets.

The Core Purpose of a CMA

The entire point of a CMA in real estate is to find that sweet spot—the price range where a home will attract serious buyers and sell in a reasonable amount of time. Pricing is a high-stakes balancing act. Go too high, and the listing just sits there, growing stale and attracting lowball offers. Go too low, and you're leaving your client's hard-earned equity on the table.

A solid CMA prevents both of these disasters by digging into three key areas:

- Actual Buyer Behavior: It looks at what buyers have actually paid for homes just like yours, which is the most powerful indicator of value.

- Current Market Competition: It sizes up the other active listings that your potential buyers are also looking at.

- Market Trends: It answers the crucial question: are prices in the area going up, down, or holding steady?

For agents, being able to consistently produce these valuable reports is what keeps business flowing. Pairing this skill with robust strategies like real estate appointment setting services ensures a steady stream of opportunities to demonstrate your expertise.

A CMA transforms an agent’s opinion into an evidence-based conclusion. It moves the pricing conversation from "I think" to "the data shows," which is critical for establishing credibility and aligning with client expectations.

Building a Compelling CMA Report from Scratch

Putting together a solid CMA feels a lot like being a detective. You're not just pulling a number out of thin air; you're building a compelling case for a property's true market value. It's about weaving a story with data that leads everyone—especially your client—to a logical and confident conclusion. And that whole story begins with finding the right evidence: the comparable properties, or "comps."

The strength of your entire analysis rests on the quality of those comps. It's the ultimate "apples-to-apples" game. You wouldn’t compare a tiny two-bedroom bungalow to a sprawling five-bedroom colonial, and the same principle applies here. The best comps are always found by zeroing in on a few critical factors that mirror how a real buyer thinks.

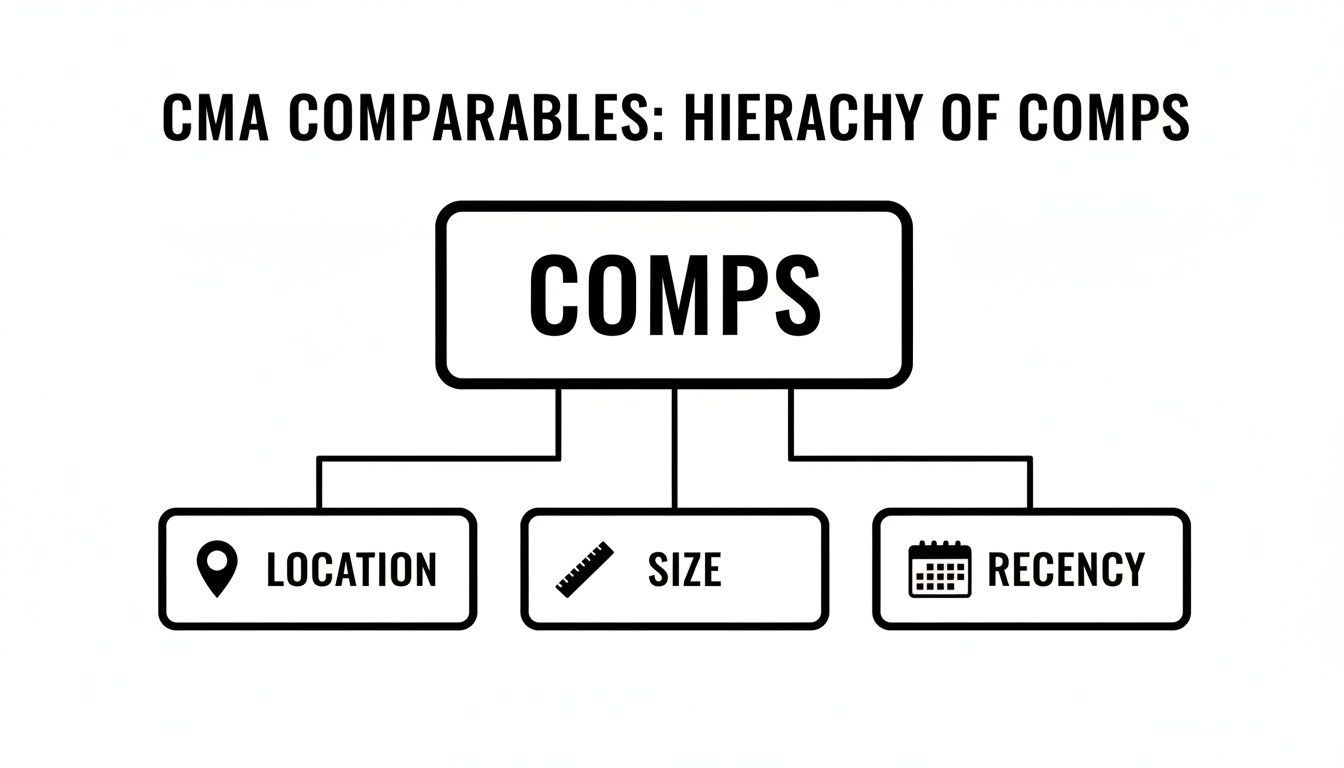

The Triad of Perfect Comps

To keep your CMA accurate and defensible, your search for comparable properties should be tightly focused on three key areas.

- Location, Location, Location: We've all heard it, and it's never been truer. A great comp should be in the same neighborhood, or at the very least, fall within the same school district. Sometimes, just crossing a busy street can put you in a completely different micro-market where values shift.

- Property Similarity: This is about more than just matching the bedroom and bathroom count. You need to look for homes with similar square footage (aim for a 10-15% variance), lot size, architectural style, and age. A charming 1920s craftsman has a different soul—and a different buyer pool—than a 2005 new-build, even if they're right next door.

- Recency of Sale: Markets breathe and change. A sale from last year might as well be from another decade in a fast-moving area. Stick to homes sold within the last 90 days for the most reliable data. If you absolutely have to, you can stretch it to six months, but you'll need to be ready to make adjustments for any market shifts during that time.

Once you’ve gathered your best sold comps, the real art begins: making adjustments. This is where an agent’s street-level expertise makes all the difference. Since no two homes are ever truly identical, you have to assign a value to their differences.

A value adjustment is how you quantify a property's unique features. It’s about answering the question, "How much more would a buyer have paid for this comp if it had a brand-new kitchen or a finished basement like my client's house?"

This process is all about local market knowledge. For instance, in your specific area, a full kitchen renovation might consistently add $20,000 to a home's value, while an extra half-bath might be worth $8,000. You apply these adjustments to your comps to level the playing field, giving you a clearer picture of what they would have sold for if they were a mirror image of the property you're pricing. Our detailed comparative market analysis template is a great resource for keeping these adjustments organized.

Reading the Full Market Story

A truly thorough CMA doesn't stop at sold properties. To get the full picture, you have to analyze everything that's happening in the market right now. This tells you about current competition and what buyers are actually thinking.

- Active Listings: These are your client's direct competition. What are they priced at? How do they present online? This is what today's buyers are seeing and comparing.

- Pending Listings: This is your freshest data. These homes show what buyers are willing to pay right now, making them a fantastic indicator of current market value.

- Expired Listings: Think of these as cautionary tales. They often highlight the pricing ceiling, showing what the market has already looked at and said, "No, thanks."

Taking this 360-degree view is what separates a good CMA from a great one, especially in a constantly shifting environment. With the global real estate market projected to hit USD 7.03 trillion by 2034, getting the price right isn't just a goal—it's essential for success. Learn more about these global real estate market trends.

How to Make Sense of the Data and Pinpoint Market Value

Once you have your list of comparable properties, the real craft of the CMA begins. This isn’t just about crunching numbers and finding an average; it's about reading between the lines to tell a story about the market and land on the right price. The best agents put on their appraiser hat, carefully weighing every piece of information to get a feel for what buyers are thinking and doing right now.

Think of Days on Market (DOM) as your market's pulse. Are similar homes flying off the market in under 15 days? That's a sign of a hot seller's market, and you might have room to be more ambitious with your price. On the flip side, if homes are sitting for more than 60 days, the market is cooler. That’s a buyer’s market, telling you a more conservative price is needed to grab attention.

Another key metric is the list-to-sale price ratio. Are homes consistently selling for 101% of the asking price, or are they closing closer to 97%? This little number tells you exactly how much wiggle room buyers have in negotiations.

Using "Bracketing" to Zero In on a Price

A powerful technique for getting a precise value is called bracketing. It’s pretty straightforward: you intentionally pick one comparable home that’s a bit better than your client's property (maybe it has a brand-new kitchen or more square footage) and one that's a bit inferior (perhaps an older roof or a less appealing yard).

This creates a high and low benchmark. Your property's value should logically land somewhere in between those two "bookends." This approach gives sellers a clear, easy-to-understand value range, shifting the focus from a single, pulled-from-the-air number to a price range backed by solid data. This is a fundamental part of the broader sales comparison approach, which is the bedrock of how most homes are valued.

Bracketing isn't about finding an average. It's about defining the absolute upper and lower limits of what a smart buyer would be willing to pay. It turns your pricing advice from a simple estimate into a well-argued conclusion based on clear market evidence.

A huge part of any CMA is digging into market trends. If you're comfortable with spreadsheets, knowing how to analyze sales data in Excel can be a great way to slice and dice the numbers from your comps. Getting a handle on these trends is what gives your pricing its context.

This chart breaks down the three core pillars we use to evaluate comparable properties for a CMA.

As you can see, location, size, and how recently a property sold are the essential filters for choosing comps that will hold up under scrutiny.

Understanding these hyper-local trends is critical, especially when the broader market picture can be misleading. For instance, in Q2 2023, while global property prices dipped slightly by 0.7% in real terms, prices in advanced economies actually edged up by 0.5%. This shows exactly why the specific data from your CMA is infinitely more valuable than what you see on the national news.

By blending this big-picture awareness with a deep dive into the local details, you can answer the million-dollar question with confidence: "What is this home actually worth?"

Common CMA Mistakes and How to Avoid Them

Even the sharpest agents can stumble when putting together a CMA. One major error is all it takes to lose a client's trust—and the listing along with it. A truly great CMA in real estate isn't just a data dump; it’s a carefully crafted story of value, backed by accuracy, context, and clear communication. The first step to building a report that clients believe in is knowing which common traps to sidestep.

One of the biggest blunders is using stale or irrelevant comps. Pulling a sale from eight months ago in a market that’s constantly in motion is like navigating a new city with an old, tattered map. The pricing landscape just moves too fast for outdated information to be of any use.

It's also easy to gloss over important property differences. Just matching the number of bedrooms and baths doesn't cut it. You have to dig deeper and account for the nuances that buyers truly care about—things like being in a top-rated school district, having a prime corner lot, or boasting a brand-new kitchen. Miss these details, and you'll end up with a shaky valuation and a flawed pricing strategy from the get-go.

Failing to Adjust for Market Conditions

Another critical pitfall is not factoring in what's happening in the market right now. A CMA built for a hot seller's market should look entirely different from one prepared when buyers have the upper hand. If you ignore key indicators like shrinking inventory or rising interest rates, you’re missing half the story.

For example, a global housing supply shortage is creating some strange and complex local conditions. The US market is a great case study; it's been somewhat 'frozen' with low sales volume, and inventory is still well below historical averages, even with a recent small increase. Walking into a listing presentation with a CMA that doesn't acknowledge these massive economic forces does your client a huge disservice. For a deeper dive, you can explore these global housing trends from Hines.

A CMA is a snapshot in time. To be accurate, it must reflect not only what has already happened (sold comps) but also what is happening right now—the economic environment, buyer sentiment, and competitive inventory.

So, how do you protect yourself from these mistakes? It all comes down to having a clear, repeatable process. Here are a few best practices you can put into action immediately:

- Establish Strict Comp Criteria: Create a set of non-negotiable rules for your comparable properties. A good starting point is focusing on sales within the last 90 days, keeping square footage within a 10% variance, and sticking to the same school district.

- Create an Adjustment Checklist: Don't just eyeball the differences between homes. Use a standardized checklist to assign a consistent value to features like an updated kitchen, a finished basement, or a new roof. This keeps your analysis objective and fair every time.

- Include an Executive Summary: Always lead your report with a simple, one-page summary. This should highlight the most important takeaways—your recommended price range and the core data supporting it. It gives clients the bottom line upfront, so they don’t get bogged down in the details.

Using AI to Make Your CMA Workflow Faster and Smarter

In a market this fast, the agent who shows up first with the best information often wins the listing. We all know the traditional way of building a CMA is solid, but let's be honest—it’s a grind. You spend hours toggling between the MLS and county records, manually copying data into spreadsheets, and triple-checking every detail.

All that administrative work is a serious drag on your business. Every hour you spend buried in data is an hour you’re not out there meeting clients, negotiating deals, or building your brand. When you're up against another agent for a listing, that delay can be the one thing that costs you the deal.

Let the Machine Handle the Heavy Lifting

This is exactly where AI-powered platforms come in and completely change the equation. Instead of you spending your afternoon hunting for comps, these systems do all the grunt work for you in a matter of seconds. They instantly scan millions of data points from the MLS, public tax records, and other property databases.

Think of it as an incredibly smart assistant. The AI uses sophisticated filters to pinpoint the most relevant comps based on dozens of variables, going far beyond what you could reasonably sift through by hand. It considers the obvious stuff like square footage and bed/bath counts, but also digs into nuanced details like architectural style and micro-market price trends.

The real power of AI isn't to replace your judgment as an agent; it's to perfect the information you work with. By automating the most time-consuming parts, AI lets you get back to what you do best: advising clients and closing deals.

From Hours of Work to a One-Minute Task

So, what does this actually look like on a typical Tuesday? A task that used to block off your entire afternoon can now be finished before your coffee gets cold. Forget logging into multiple systems and copy-pasting data. You just type in the property address.

The AI takes it from there, generating a detailed, data-rich CMA real estate report almost instantly. Imagine getting a call from a new lead and being able to send them a professional valuation before your competitors have even had a chance to open their laptops. There are some fantastic examples of real estate CMA software that deliver this kind of speed.

Switching to a modern, tech-driven approach gives you some pretty clear advantages:

- Get Your Time Back: Automating CMAs frees up huge chunks of your week, letting you focus on activities that actually make you money.

- Ditch the Boring Stuff: No more manual data entry or wrestling with spreadsheets. The system handles it all.

- Create CMAs Anytime, Anywhere: You can pull a complete, accurate report right in the middle of a client meeting, showing off your expertise on the spot.

Ultimately, AI platforms act as a powerful sidekick. They handle the tedious administrative work, allowing you to operate more efficiently. This frees you up to spend your energy on strategy, presentation, and negotiation—the things that secure better deals for your clients and win you more business.

Common Questions About Real Estate CMAs

Even after getting the hang of the process, a few key questions always seem to pop up about the CMA in real estate. Getting straight answers to these is crucial. It builds trust between you and your clients and makes sure everyone feels confident before settling on a price.

Let's tackle some of the most common questions head-on to clear up any lingering confusion.

What's the Real Difference Between a CMA and an Appraisal?

Think of it this way: a CMA is a real estate agent’s strategic game plan for pricing a home to sell, while an appraisal is a formal, legally recognized valuation done by a licensed appraiser for a lender.

Both use comparable sales, absolutely. But a CMA is all about finding that sweet spot—the optimal list price to attract buyers and generate offers. An appraisal, on the other hand, is done to assure the bank that the property is worth the loan amount. One is for marketing; the other is for financing.

How Far Back Should You Look for Comps?

For the sharpest picture of the current market, comps sold within the last 90 days are the gold standard. In a hot or quickly shifting market, I’d even argue that the last 30 to 60 days are far more telling.

You can stretch it to six months if you absolutely have to, especially in areas with low turnover. But if you do, you have to be ready to make some serious adjustments for how the market has changed in that time. Anything older than six months? It's probably too dated to be of much use.

A professional CMA is an expert analysis, not just an algorithm-generated estimate. It blends hard data with an agent’s irreplaceable understanding of neighborhood nuances, buyer psychology, and a property's unique story.

Can a Homeowner Just Run Their Own CMA?

Sure, a homeowner can pull up public records and look at online home value estimators. But those tools are worlds away from the accuracy and real-time data found in the Multiple Listing Service (MLS), which only licensed agents can access.

More importantly, automated tools can't walk through a house. They can't see the brand-new kitchen, factor in the weird layout, or understand the subtle differences between one side of the street and the other. That’s where an agent’s on-the-ground expertise makes all the difference.

Ready to create lightning-fast, data-driven CMA reports that win listings? Saleswise generates comprehensive, client-ready CMAs in about 30 seconds. Start your $1 seven-day trial and see how our AI platform can transform your workflow at https://www.saleswise.ai.