What is a Broker Price Opinion: Quick Guide for Homeowners and Agents

Ever heard of a Broker Price Opinion, or BPO? Think of it as a seasoned real estate pro’s take on what a property is worth right now. It’s like getting a quick, expert diagnosis from a skilled mechanic—it’s not the full, tear-down inspection, but it’s a highly educated estimate based on years of experience and a look at current conditions.

For lenders, homeowners, and investors who need a solid valuation without the time and expense of a full appraisal, a BPO is often the perfect solution.

Decoding the Broker Price Opinion

At its heart, a Broker Price Opinion is just that—an opinion. It’s an informed judgment from a licensed real estate broker or agent on a property's likely selling price in the current market.

This isn't a random guess. The agent becomes a bit of a detective, piecing together clues from comparable sales, neighborhood trends, and the property's condition to arrive at a probable value. It’s a more streamlined and much more affordable snapshot compared to a formal appraisal, which is a legally binding valuation.

To give you a clearer picture, here’s a quick rundown of what defines a BPO.

BPO at a Glance: Key Characteristics

| Characteristic | Description |

|---|---|

| Purpose | To estimate a property's probable selling price for internal decision-making. |

| Prepared By | A licensed real estate broker or agent with local market expertise. |

| Cost | Typically ranges from $30 to $100, offering a cost-effective alternative to appraisals. |

| Turnaround Time | Fast, usually completed within a few days. |

| Legal Standing | It is an opinion of value, not a legally-binding appraisal. |

| Common Uses | Foreclosures, short sales, loan modifications, portfolio reviews, and PMI removal. |

This table highlights why BPOs are so valuable in situations where speed and cost are the top priorities.

Who Relies on BPOs and Why?

The demand for BPOs comes from a need for fast, reliable property valuations in a variety of situations. They're a go-to tool for:

- Lenders and Banks: Especially during foreclosures or short sales, financial institutions need a quick and inexpensive way to understand the value of assets on their books.

- Homeowners: A BPO can be a smart way to get a baseline for setting a competitive listing price. It can also provide the necessary data to ask a lender to remove Private Mortgage Insurance (PMI).

- Real Estate Investors: Savvy investors use BPOs all the time to quickly evaluate potential deals or check the current value of properties in their portfolio.

The real appeal of a BPO is its efficiency. Where a formal appraisal might cost $240 to $450 and take weeks, a BPO gives a solid, informal estimate for a fraction of the price. Their use really took off after the 2008 financial crisis, when lenders were swamped with foreclosures and needed a cost-effective way to value thousands of properties.

A BPO empowers stakeholders with a data-backed opinion of value, facilitating faster decisions in situations where a full appraisal would be impractical or too slow.

Mastering BPOs as a Strategic Advantage

For real estate agents, doing BPOs isn't just about earning a little extra income. It's a fantastic way to sharpen your market knowledge. Each one you complete deepens your understanding of local trends, what buyers are looking for, and how pricing works in a specific neighborhood.

This expertise pays off everywhere—it leads to more accurate CMAs, more confident listing presentations, and a real competitive edge. And while agents are busy conducting BPOs, managing the constant flow of client calls is crucial; this is where specialized real estate agent support services can be a huge help, freeing up time to focus on high-value tasks.

Anatomy of a Broker Price Opinion Report

To really get what a Broker Price Opinion is all about, you have to look under the hood. A good BPO isn't just a number pulled out of thin air; it’s a detailed report that tells the story of a property's value, backed by solid evidence and an agent's on-the-ground expertise.

Think of it as building a legal case for a specific price. Each section of the report provides a critical piece of testimony, transforming a simple opinion into a credible valuation tool for everyone from homeowners to big banks. It all starts with a close look at the property itself.

The Foundation: Property and Neighborhood Analysis

First things first, any BPO worth its salt dives deep into the details of the subject property. This is way more than a quick glance. The agent documents everything meticulously—square footage, room count, the quality of the construction, and any recent upgrades or glaring issues.

At the same time, they're sizing up the neighborhood. This is huge, because a home’s value is directly tied to its surroundings. Key factors include:

- Local Market Vibe: Are prices in the area trending up, down, or are they flat?

- Neighborhood Upkeep: Do the neighboring homes look well-maintained or run-down?

- Amenities and Access: How close is it to good schools, parks, shopping, and transportation?

- Vacancy Rates: A lot of empty homes can be a red flag for a struggling market.

This combined analysis paints a complete picture of the property in its natural habitat, setting the stage for the actual valuation.

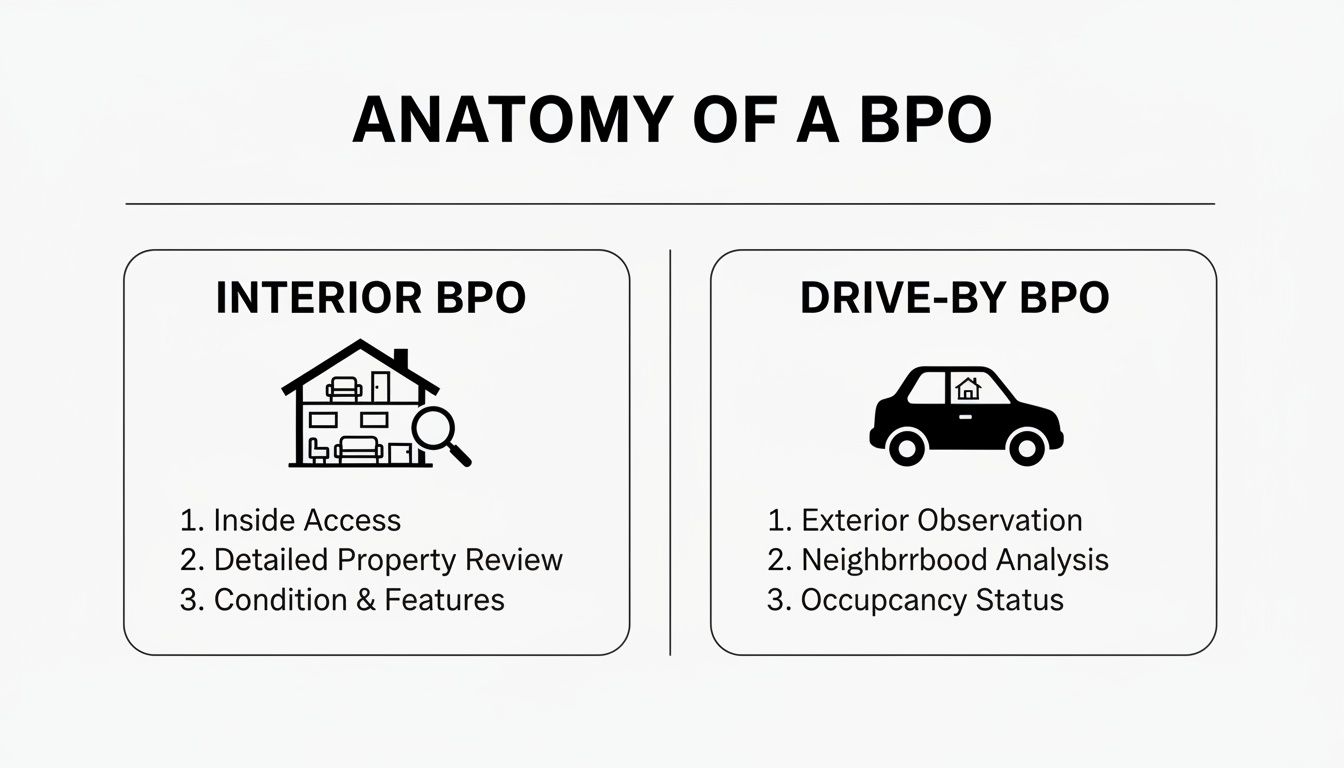

Drive-By BPO vs. Interior BPO

Not all BPOs are created equal. The level of inspection really changes the game, and it generally comes in two flavors: the drive-by BPO and the interior BPO.

A drive-by BPO is exactly what it sounds like. The agent evaluates the property from the street, checking out its curb appeal, exterior condition, and the general state of the neighborhood. It’s a faster, cheaper option often used when getting inside isn't possible, like with some occupied foreclosures.

An interior BPO, on the other hand, is the full deep-dive. The agent walks through the entire property, snapping photos and taking detailed notes on every room. This gives them a much more accurate read on the home’s actual condition, maintenance, and the quality of any updates. It's more work, but it almost always leads to a more precise and reliable valuation.

A BPO's credibility hinges on its ability to justify the final price. Great photos and sharp, insightful commentary aren't just fluff—they are the core evidence that backs up the agent's professional opinion.

The Heart of the Report: Comparable Sales Data

Now for the most important part of any BPO: the analysis of comparable properties, or "comps." This is where an agent’s local market knowledge truly shines. They hunt down recently sold and currently listed properties that are as similar to the subject property as possible.

This whole process is the foundation of the sales comparison approach, a core valuation method in real estate. (If you want to get into the weeds on this, check out our guide on the sales comparison approach in real estate).

The comps are usually laid out in a grid, making it easy to compare them side-by-side. But the agent doesn’t just list them; they make specific value adjustments for any key differences. For example, if a comp sold for $450,000 but has a brand-new kitchen and the subject property doesn't, the agent will adjust that comp's price downward to level the playing field.

It's this careful process of adjustments, combined with a thorough property analysis and clear photo evidence, that gives a BPO its strength. It’s a carefully built argument for a property’s value, designed to be logical, transparent, and grounded in real-world market data.

BPO vs CMA vs Appraisal: The Agent's Guide to Valuation

Knowing the difference between property valuation methods is what separates a good agent from a great one. While they all circle the same goal—figuring out what a property is worth—a Broker Price Opinion (BPO), a Comparative Market Analysis (CMA), an Appraisal, and an Automated Valuation Model (AVM) are entirely different tools for different jobs.

Think of it like a mechanic’s toolkit. You wouldn't use a sledgehammer to change a tire. Likewise, understanding when to use each valuation method helps you guide clients with confidence, manage their expectations, and cement your status as a true market expert.

The Agent-Driven Tools: BPO and CMA

At first glance, a BPO and a CMA look like close cousins. Both are prepared by real estate professionals and rely on market data. The real difference is who they're for and why.

A BPO is a more formal report, usually ordered by a third party like a bank or mortgage lender for their own internal use. You’ll see them most often in situations involving distressed properties, like foreclosures or short sales.

On the other hand, a Comparative Market Analysis (CMA) is a strategic tool agents build for their own clients. It’s all about helping a seller land on the perfect listing price or guiding a buyer to make a winning offer. It’s less about filling out a rigid form and more about providing your expert interpretation of the market. If you’re looking to sharpen this core skill, our guide on how to do a comparative market analysis breaks it down step-by-step.

The Legally Binding Standard: The Appraisal

This is the heavyweight champion of property valuation. An appraisal is a formal, legally recognized opinion of value conducted by a state-licensed or certified appraiser. Unlike agents performing BPOs or CMAs, appraisers are bound by a strict set of national standards called the Uniform Standards of Professional Appraisal Practice (USPAP).

This is why lenders require an appraisal for nearly every mortgage. It provides an unbiased, third-party assessment of the property's value, which acts as the collateral for the loan. While your BPO or CMA provides a strategic market opinion, an appraiser’s report is a defensible, legal valuation.

The Automated Algorithm: The AVM

An Automated Valuation Model (AVM) is exactly what it sounds like: a computer algorithm that spits out a property value. This is the technology powering the instant online estimators you see on sites like Zillow. It works by crunching public records, sales data, and complex mathematical models.

AVMs are incredibly fast and can assess huge portfolios in seconds. But they have a major blind spot: they lack human intelligence. An AVM can't see the stunning new kitchen renovation or notice that the house next door is falling apart—critical context that a skilled agent spots immediately.

The infographic below shows the two main flavors of BPOs, which highlights just how much the level of detail can vary.

This distinction between a quick drive-by and a full interior inspection is crucial, as it directly impacts the reliability of the final number.

Valuation Methods Compared BPO vs CMA vs Appraisal vs AVM

To really nail down the differences, seeing these four methods side-by-side is the clearest way to understand their unique roles. Knowing these distinctions is key to advising your clients and choosing the right tool for their needs.

| Valuation Method | Performed By | Typical Cost | Turnaround Time | Primary Use Case | Legal Standing |

|---|---|---|---|---|---|

| Broker Price Opinion | Real Estate Agent/Broker | $30 - $100 | 1-3 Days | Bank decisions (foreclosures, short sales) | Opinion of value, not an appraisal |

| CMA | Real Estate Agent/Broker | Often Free (for clients) | Hours to 1 Day | Setting listing price, making offers | Strategic pricing tool, not legal |

| Appraisal | Licensed Appraiser | $240 - $450+ | 1-2 Weeks | Mortgage underwriting, legal matters | Legally recognized valuation |

| AVM | Computer Algorithm | Free to Low Cost | Instant | General estimates, portfolio analysis | Data-driven estimate, no legal authority |

Choosing the right valuation method is about matching the tool to the task. A CMA is for strategic client advice, a BPO is for internal bank decisions, and an appraisal is for legally required valuations.

In the end, each method has its place. An AVM gives you a quick snapshot, and an appraisal provides legal certainty. But the BPO and CMA are where an agent's real value shines—blending hard data with priceless, on-the-ground market intelligence to arrive at a truly informed opinion of value.

How BPOs Are Used in Today's Market

A Broker Price Opinion isn't just a theoretical number on a page; it's a workhorse document that drives major financial decisions. Think of it as a crucial tool for anyone in the real estate world who needs a solid valuation without the time and expense of a full appraisal.

The real magic of a BPO is its application in complex, fast-moving situations. It's in these moments—from handling a foreclosure to advising a seller—that you can see just how essential the BPO has become in the modern market.

Key Use Cases for Financial Institutions

For lenders and asset managers, BPOs are the go-to solution for managing risk and making quick, informed decisions about their property portfolios. Their reliance on these reports isn't new; it's a battle-tested strategy.

In fact, the use of BPOs absolutely exploded during the U.S. housing crisis. Foreclosure-related orders skyrocketed 300% from 2007-2010 as banks scrambled to get valuations for over 10 million underwater loans. By 2012, BPO pros were churning out hundreds of thousands of reports a year. You can get more context on this evolution from Experian's detailed breakdown.

Today, BPOs remain a staple for financial institutions in several key scenarios:

- Foreclosures and REO Properties: Once a bank takes back a property (making it "Real Estate Owned" or REO), the clock starts ticking. They need to price it to sell, and a BPO gives them that fast, market-based valuation to move the asset off their books.

- Short Sale Negotiations: In a short sale, a lender is agreeing to take a loss. Before they approve the deal, they need to know the proposed price is fair. A BPO is the perfect tool to verify the property’s current market value.

- Loan Modifications: When a homeowner requests a loan modification, the lender needs to understand their collateral position. Ordering a BPO gives them a current snapshot of the home's value, which is critical for structuring a new agreement.

- Portfolio Valuations: Imagine you're an investment firm holding thousands of mortgages. You need to know what that portfolio is worth. BPOs provide a cost-effective way to get a pulse on the value of a huge number of properties all at once.

A BPO gives lenders a clear, on-the-ground perspective of a property's value, enabling them to navigate distressed asset situations with greater confidence and speed.

How Top Agents Leverage BPO Principles

Smart agents don't just complete BPOs for extra cash. They weave the meticulous, data-driven process of a BPO into the very fabric of their business. It’s a way to sharpen their pricing skills and become the undeniable market expert for their clients.

For example, a top agent preparing for a listing presentation will often create something much more robust than a simple CMA. It’s a "BPO-like" analysis, complete with detailed notes on the property's condition, the vibe of the neighborhood, and specific, justifiable adjustments for every comparable sale. This approach anchors the pricing conversation in hard data, not just hopeful numbers.

This strategy gets results. In many major markets, BPOs are the quiet force behind 15-20% of listing decisions, giving sellers the confidence to price their homes correctly from the start. This clarity often leads to a quicker sale, trimming transaction times by an average of 10-15 days. By adopting this rigorous valuation mindset, agents build unshakable trust, defend their pricing strategy, and ultimately win more business.

Navigating the Legal and Ethical Rules of BPOs

When you complete a Broker Price Opinion, you’re taking on a serious professional responsibility. This isn't just a casual estimate you jot down on a napkin; it’s a formal opinion of value that financial institutions and asset managers rely on. Getting this right is about more than just good business—it’s about protecting your license and your reputation.

The whole process boils down to one fundamental truth: a BPO is not an appraisal. That’s not just splitting hairs; it's a critical legal line in the sand. Appraisals are done by state-licensed appraisers who are bound by the rigorous Uniform Standards of Professional Appraisal Practice (USPAP). A BPO, on the other hand, is a real estate professional's opinion, created for internal decisions and governed by a patchwork of state-specific laws.

Who Can Perform BPOs? Check Your State's Playbook

The rules on who can legally perform a BPO for a fee can change dramatically the moment you cross state lines. You’ll always need to be a licensed real estate agent or broker, but many states have their own specific hoops to jump through. Getting it wrong can lead to some hefty fines or even a mark against your license.

It’s completely on you to know your local laws inside and out. Before you even think about offering BPO services, you need to know:

- Are you authorized? Does your state’s law explicitly allow licensed agents to perform BPOs for compensation?

- What’s the required lingo? Do you need to include specific disclaimers, like "This is not an appraisal," to make sure everyone is crystal clear?

- Where can it be used? Are there restrictions on what a BPO can be used for? For instance, almost every state forbids using a BPO to originate a brand-new mortgage.

These same principles apply in the commercial world, too. In major markets, a Broker Opinion of Value (BOV) serves as a quicker, cheaper alternative to a full-blown commercial appraisal. While states like Florida have specific statutes that regulate BPOs and draw a hard line against them being called appraisals, these reports have been crucial in facilitating deals like short sales. You can dive deeper into the role of BPOs in commercial real estate to see how these rules play out in that arena.

Your Ethical Compass: Staying Objective and Transparent

Beyond the letter of the law is the spirit of professional ethics. Your credibility as an agent is your most valuable asset, and it all rests on your commitment to being objective and transparent. Every BPO you sign your name to should be an unbiased take on the market, completely free of your own self-interest or a client’s wishful thinking.

At the end of the day, a BPO is about providing an honest, data-backed opinion of value. Anything that clouds your judgment or compromises your objectivity defeats the entire purpose and puts your professional integrity on the line.

To keep your work ethically sound, make these principles your guide:

- Disclose Any Conflicts: If you have any potential skin in the game—like hoping to win the listing on an REO property you’re evaluating—you have to state that upfront. Honesty isn’t just the best policy; it’s the only policy.

- Stick to the Facts: Your final number must be a direct result of your market analysis. Never fudge the value up or down just to make a client happy.

- Set Clear Expectations: Make sure your client knows exactly what a BPO is and, just as importantly, what it isn’t. Clearly explain its purpose and its limitations so it doesn’t get used in the wrong way.

By truly understanding and following these legal and ethical guardrails, you can confidently add BPOs to your professional toolkit. You'll be providing a much-needed service while keeping your license and your integrity firmly intact.

Get BPO-Level Insights in Seconds with Saleswise

A formal Broker Price Opinion is a fantastic tool for its specific purpose, usually for a bank or in a distressed sale. But the core idea—getting a fast, accurate, data-supported price—is something every agent needs to do every single day. In a market that changes by the hour, you simply can't afford to wait days for a valuation. You need that intelligence right now.

This is where today’s tools give you a serious upper hand, taking you beyond the old BPO model to meet the immediate demands of a client conversation. Forget the manual report for a lender; imagine creating a full, client-friendly pricing analysis right there in the seller's living room.

Today's BPO, Reimagined for Agents

That’s exactly what Saleswise was built for. Our platform takes the same disciplined, evidence-based approach of a BPO and automates it, producing a professional and persuasive Comparative Market Analysis (CMA) in about 30 seconds. It’s like having a personal pricing specialist on call, ready to crunch the numbers and deliver a solid valuation on the spot.

This completely sidesteps the time-sucking manual work that gets in the way of even the most seasoned pros. Saleswise instantly scours the market for the best comps and lays out the data in a clean, convincing way that builds immediate confidence with your clients.

From Manual Grind to Automated Edge

The real game-changer is how this transforms your day-to-day work. Instead of spending hours buried in the MLS, trying to make manual adjustments for every little property difference, you can put your energy into strategy and building relationships. Saleswise does the heavy lifting, handing you back valuable time while making you look even sharper.

Here’s how it helps you win more business:

- Instant Answers on Pricing: When a homeowner asks, "So, what's my place worth?" you can give them a real, data-driven answer on the spot, not "I'll get back to you."

- Build Credibility with Data: Walking in with a polished, visually engaging report that clearly shows your homework cements your status as the local market expert.

- Secure More Listings: Agents who can quickly and confidently explain their pricing strategy are the ones who walk away with the signature.

By combining the analytical rigor of a Broker Price Opinion with the speed of modern tech, you get a powerful competitive advantage. You’re no longer just offering an opinion; you're delivering data-backed intelligence that helps clients make big decisions.

This approach gives you the quality of BPO insights without the BPO-level effort. It's all about using technology to provide better service, work smarter, and ultimately, close more deals.

Ready to see how you can create expert-level pricing reports in just a few clicks? Take a closer look and book a personalized Saleswise demo to see it in action.

Common Questions About Broker Price Opinions

When you're dealing with property values, a lot of questions pop up. Let's clear the air and tackle some of the most common things agents ask about BPOs and how they work.

Can Any Real Estate Agent Do a BPO?

Not quite. You definitely need a real estate license, but that's just the starting point. The rules can be wildly different from one state to the next. Some states might require you to get a special certification, while others have specific legal language you must include in your reports.

On top of that, the banks and asset management companies that order BPOs usually have their own exclusive list of agents they work with. To get on that list, you'll often need to complete specific training or show them you have a solid track record. The best first step is to always check with your state's real estate commission and the company asking for the BPO to see what they require.

How Much Money Can I Make Doing BPOs?

For a single Broker Price Opinion, you can expect to earn somewhere between $30 and $100. The exact amount really depends on a few things: how complex the report is, where the property is located, and what the client typically pays.

An interior BPO, where you have to go inside and inspect the property, will always pay more than a quick drive-by. While the individual fees aren't huge, many agents find it’s a great way to earn extra income, especially if they can build a system to handle several at once. It's also a fantastic way to become the go-to expert on a neighborhood and keep your finger on the pulse of the market.

Is a BPO a Legal Substitute for an Appraisal?

No, and this is a really important point to understand. A BPO is a professional opinion of what a property is worth, but it's not the same as a formal appraisal.

A Broker Price Opinion is a tool used for internal decisions, like helping a bank figure out its next move with a distressed property. It doesn’t have the legal authority needed for things like mortgage lending, fighting property taxes, or settling an estate. Those situations always require a full valuation from a state-licensed appraiser.

How Does a Tool Like Saleswise Fit into All This?

Think of a platform like Saleswise as the modern-day evolution of the BPO's core purpose, but built for an agent’s everyday work with clients. It doesn't replace the formal BPOs needed for bank foreclosures, but it completely automates the tedious research and number-crunching you'd do to arrive at an accurate price.

When you're in a listing presentation or helping a buyer decide on an offer, Saleswise gives you that BPO-level accuracy and data-backed confidence in a matter of seconds. This means you can spend your time building relationships and mapping out a strategy for your clients, not getting stuck doing manual data entry.

Ready to deliver BPO-level insights without the manual effort? Saleswise generates stunning, data-driven CMAs in about 30 seconds, helping you win more listings and advise clients with confidence. Explore the future of property valuation.