What is fair market value: A Practical Guide to Real Estate Pricing

Fair market value is the price a property would sell for on the open market. It's the number a willing buyer and a willing seller would agree on, assuming neither is under duress and both know all the important details about the property.

Unpacking Fair Market Value In Real Estate

Think of fair market value (FMV) as the "sweet spot" in real estate. It’s not just a hopeful guess or a wishful number plucked from thin air. It's a well-reasoned estimate that truly reflects the pulse of the current market.

This value is what a home is genuinely worth right now, striking that perfect balance between what a seller wants and what a buyer is actually prepared to pay. Getting a handle on FMV is non-negotiable for agents; it's the bedrock of almost every transaction, from nailing down a listing price to crafting a winning offer.

Fair market value represents the price at which a property would sell under normal market conditions between a willing buyer and willing seller, neither being under pressure to buy or sell.

It’s a living number, completely different from a property's historic cost—what someone paid for it years ago. FMV is all about what today's buyers care about, factoring in everything from a great view and a new kitchen to the vibe of the neighborhood. As an agent, your main tool for pinpointing this number is a comparative market analysis (CMA), where you dive into recent sales of similar homes to set a realistic and competitive price.

Distinguishing FMV From Other Valuations

In the world of real estate, valuation terms get thrown around all the time, and it's easy for clients (and even new agents) to get them mixed up. Let's clear up the confusion.

Below is a quick cheat sheet to help you distinguish fair market value from its common cousins: appraised value and assessed value.

Quick Guide To Real Estate Valuation Terms

| Valuation Term | Definition & Purpose | Who Determines It? |

|---|---|---|

| Fair Market Value (FMV) | An estimated price based on current market conditions, representing what a willing buyer would likely pay a willing seller. Used for listing, negotiating, and general valuation. | Real Estate Agent (via CMA) |

| Appraised Value | A formal, data-driven opinion of value created for a specific purpose, usually for a lender to secure a mortgage loan. | Licensed Appraiser |

| Assessed Value | A value assigned by a municipal or county authority solely for the purpose of calculating property taxes. It's often lower than market value. | Local Government Assessor |

Knowing these differences is key. An agent's job is often to navigate the space between these different figures. For example, a lender will lean heavily on the appraised value, which they need to make sure the property is solid collateral for the loan. Homeowners often encounter this when they need an appraisal for refinance.

Meanwhile, the assessed value is purely for the tax man and isn't a reliable guide for what a home will sell for. Your role is to use your market expertise and a thorough CMA to establish a strategic FMV that attracts the right buyers and gets the deal done.

How Modern Market Data Shapes Property Value

A solid fair market value estimate isn't pulled out of thin air. It’s built on a bedrock of reliable, up-to-the-minute market data. Knowing where this information comes from is the first step in trusting the entire valuation process, because the quality of the data directly impacts the accuracy of any CMA or appraisal.

Think back just a few decades ago—property information moved slowly and was often fragmented. Today, we're working with advanced, interconnected systems that deliver real-time insights into what’s happening in any given neighborhood. This shift has completely changed the game, giving us incredible speed and precision when pricing a home.

The Evolution of Real Estate Data

Real estate data collection has become far more systematic and powerful over the years. In Canada, for example, market value data has long been gathered through professional networks and government programs. While Statistics Canada used to track new home values, the modern gold standard is the Canadian Real Estate Association's MLS® Home Price Index.

This index is updated monthly using more than 15 years of MLS data, and it specifically tracks the price of "typical" homes across different property types. This gives us a much clearer view of local value trends than we ever had before. You can learn more about how this historical data is compiled and used to get a feel for the depth involved.

It's this modern data infrastructure that makes the essential "apples-to-apples" comparisons of a CMA possible. It’s the engine running in the background, turning millions of data points into a clear picture of what a property should actually sell for.

From Raw Data to Actionable Insights

Having access to an ocean of data is one thing; knowing what to do with it is something else entirely. The real skill lies in interpreting this information to build a strategic pricing recommendation. It goes way beyond just looking at the final sale prices of nearby homes.

Several key data points are crucial for painting the full picture of fair market value:

- Days on Market (DOM): Are similar properties flying off the market or sitting for weeks? A low DOM signals a seller's market, which can push values up.

- List-to-Sale Price Ratio: Are homes consistently selling for above or below their list price? This ratio is a fantastic indicator of buyer demand and negotiating power.

- Inventory Levels: How many homes are available compared to the number of active buyers? When inventory is tight, scarcity can drive prices higher.

To really get a handle on how this works, you need to understand how to use comparable sales, or "comps." They are the fundamental building blocks of any reliable valuation. Learning more about finding free real estate comps is a great practical step for anyone wanting to value a property accurately.

Today’s software can synthesize these complex variables in seconds. This frees up agents to focus less on data gathering and more on strategy, turning that information into a genuine competitive advantage for their clients.

Your Toolkit for Nailing Fair Market Value

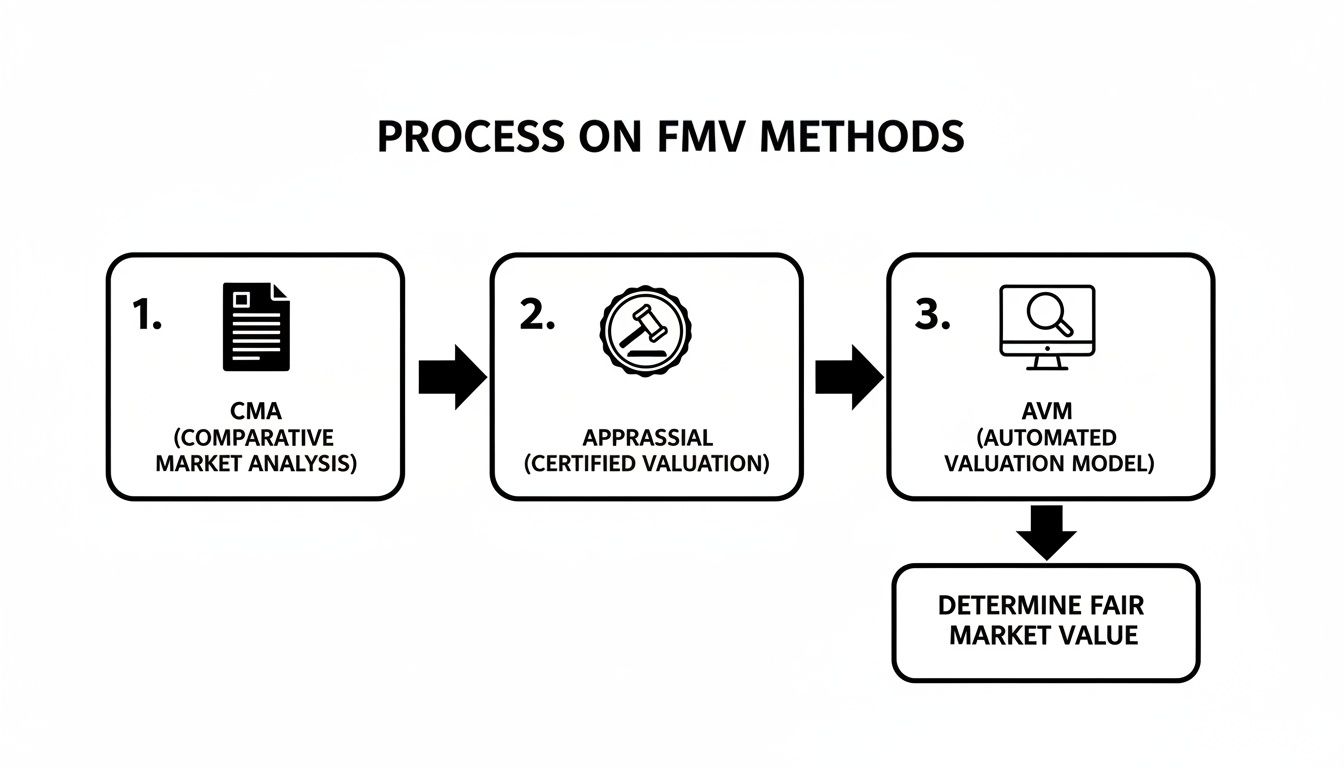

Pinpointing a property’s fair market value isn't about guesswork; it's about having the right tools in your belt. As a real estate agent, you have three primary methods to go from a gut feeling to a rock-solid, defensible price. Each one plays a different role at a different stage of the game.

Knowing how to use and explain these tools is what sets a pro apart. Let's break down the big three you'll be working with every day: the Comparative Market Analysis (CMA), the formal appraisal, and the Automated Valuation Model (AVM).

The Agent’s Go-To: The Comparative Market Analysis (CMA)

The Comparative Market Analysis (CMA) is your single most important tool for determining what a home is truly worth in the current market. Think of it as a strategic deep-dive into the local market's most recent activity. It’s a detailed report you build that analyzes recently sold properties in the area that are genuinely similar to your client's home.

A well-crafted CMA tells a story that algorithms just can't. It accounts for the little things that make a big difference—that stunning new kitchen, the premium corner lot, or even a less-than-ideal view. This is your primary instrument for advising sellers on a smart listing price and helping buyers write an offer that gets taken seriously. A strong CMA is the backbone of your professional opinion.

Want to master this? Check out our complete guide on how to do a comparative market analysis.

The real power of a CMA is how it blends hard data with your professional judgment. It’s grounded in comparable sales—the best indicator of FMV—but gives you the flexibility to adjust for the unique quirks and features of a property and the feel of the market right now.

The Lender’s Checkpoint: The Formal Appraisal

Next up is the formal appraisal. This is a much more rigid and standardized valuation. While you use a CMA to craft a pricing strategy, an appraisal is almost always required by the lender before they’ll cut a check for a mortgage. Its main job is to protect the bank's investment by making sure the property is actually worth what the buyer is borrowing.

A state-licensed appraiser is the one who carries out this evaluation. They follow a strict set of rules to produce an official, legally defensible opinion of value. It's less about finding a competitive price to attract buyers and more about providing a conservative, data-driven number for the bank's records.

- Who does it? A state-licensed and certified appraiser.

- Why is it done? To confirm the property's value for the lender.

- When does it happen? During the mortgage underwriting process, for both purchases and refinances.

The Instant Estimate: Automated Valuation Models (AVMs)

Finally, there are Automated Valuation Models (AVMs). You’ve seen these everywhere—they're the computer algorithms that power those "get your home's value instantly" tools on major real estate websites. AVMs churn through massive amounts of public data and market trends to spit out a quick valuation.

AVMs are fine for a ballpark figure, but they can be wildly inaccurate for setting a real-world price. They often don't have the latest MLS data and have no way of knowing about the property's condition, recent upgrades, or other unique features. Think of them as a starting point for a conversation, but never, ever the final word.

To make it easier to see how these methods stack up, here’s a quick comparison. This is a great way to explain to clients why your CMA is so much more reliable than the online estimate they found.

Comparing FMV Determination Methods

| Method | Primary Use | Key Strengths | Potential Weaknesses |

|---|---|---|---|

| Comparative Market Analysis (CMA) | Setting a listing price; making an offer | Current, local data; factors in condition & upgrades; agent expertise | Can be subjective; quality depends on agent's skill |

| Formal Appraisal | Securing a mortgage | Standardized, objective process; legally defensible value | Can be conservative; may not reflect current market speed; costs money |

| Automated Valuation Model (AVM) | Quick, initial estimate | Instant results; free to use; good for a general idea | Often inaccurate; doesn't know property condition; uses dated info |

As you can see, each tool has its place. An AVM gives a quick snapshot, an appraisal provides a safety net for the lender, but the CMA is where your strategic expertise truly shines. It’s the method that combines real-time data with real-world insight to land on the right price.

How to Craft a Defensible Fair Market Value Estimate

Pinning down a property's fair market value is part science, part art. It’s a methodical process that goes way beyond a simple price-per-square-foot calculation to tell the complete story of a home's worth. When you build this defensible price, you instill trust in your clients and give your advice real authority.

The bedrock of any solid FMV estimate is the sales comparison approach. This means finding recently sold properties—we call them "comps"—that are genuinely comparable to your client's home. From there, you make strategic adjustments for all the ways they differ. Think of it as leveling the playing field to see how the properties truly stack up against each other.

Finding Truly Comparable Properties

First things first: you have to identify the right comps. This is the most critical step, because a poor selection will throw off your entire analysis from the start. Your goal is to find the exact homes a potential buyer would have seriously considered right alongside your client's property.

To make sure your comps are rock-solid, they need to check a few boxes:

- Recency: The sale must have closed recently, ideally within the last 90 days. Markets can turn on a dime, so older sales just aren't reliable indicators of today's value.

- Proximity: Comps should be in the same neighborhood or a very similar one, usually within a one-mile radius. Keep in mind that a major road, park, or train tracks can create distinct micro-markets.

- Similarity: The properties have to be alike in style, size, age, bedroom/bathroom count, and overall condition. A four-bedroom colonial is simply not a good comp for a two-bedroom ranch.

Making Smart Value Adjustments

Once you've got a solid set of 3-5 comps, the real analysis begins. It's almost impossible to find a perfect clone of your subject property, so you'll need to make value adjustments to account for the differences. It’s like handicapping a race; you add a little weight for advantages and take some off for disadvantages.

If a comp has a feature your client's home lacks (like a swimming pool), you subtract the value of that feature from the comp's sale price. On the flip side, if your client's home has an upgrade the comp is missing (like a brand-new kitchen), you add that value to the comp's price. The most common adjustments are for square footage, lot size, upgrades, and condition. For a deeper dive, our guide on the sales comparison approach unpacks these adjustments in more detail.

The core principle is simple: every adjustment is made to the comparable property's sale price, not the subject property. Your goal is to answer the question, "What would this comp have sold for if it were identical to my client's home?"

This flowchart breaks down the primary methods agents and appraisers use to arrive at a property's value.

As you can see, while automated valuations (AVMs) offer a quick starting point and formal appraisals serve as an official checkpoint, the Comparative Market Analysis (CMA) remains the agent's go-to tool for strategic pricing.

Analyzing Market Trends and Finalizing the Range

Finally, it's time to layer in the current market dynamics. Take a hard look at the average days on market (DOM) for your comps. If they all sold in under a week with multiple offers, it’s a sign of a hot market where you can price more assertively. But if they sat for 60 days before selling, a more conservative starting price is probably the smarter play.

After adjusting each comp, you'll be left with a range of adjusted sale prices. This reconciled range—not a single, rigid number—is your fair market value estimate. Presenting a strategic price range (say, $490,000 to $510,000) gives your clients realistic expectations and builds in flexibility for negotiations. What used to be a manual effort taking hours can now be done in minutes with good CMA software, giving you a defensible estimate that backs up your expertise.

How Fair Market Value Behaves in Different Markets

Fair market value isn't a static number etched in stone. It’s more like a living, breathing metric that ebbs and flows with the unique story of a local market. It's constantly being shaped by the push and pull of buyer demand, seller motivation, and what’s actually on the market at any given moment.

Grasping this dynamic is critical. A nationwide headline about the housing market tells you almost nothing about what's happening on a specific street in your town. The real story is always local, and the forces driving value can shift dramatically from one neighborhood to the next.

Reading the Market’s Unique Signals

It's a common assumption: if fewer homes are selling, prices must be dropping. But that’s not always how it plays out. Fair market value is ultimately determined by what a willing buyer actually pays for the properties that are available, not just by the raw number of transactions.

Imagine a market where sales volume dips, but the buyers who remain are incredibly motivated. In that kind of environment, the fair market value for desirable homes can actually climb as those buyers compete fiercely for a smaller pool of listings. This is how you can end up with a market where prices are rising even as sales numbers are falling—a signal that’s confusing without the right context.

A Tale of Three Cities

Recent housing market data gives us a perfect real-world example of this in action. In January 2026, Montreal's market saw the average home sell for $651,066, a 5% annual increase, even as the market's dynamics were shifting.

At the very same time, the trends in other major Canadian cities were completely different. Vancouver saw a tiny 0.2% year-over-year price increase, while Toronto experienced a 6.5% decline. This really drives home how value is dictated by what motivated buyers in each specific market are willing to pay. You can dig into these divergent Canadian housing market trends to see the full data story.

This hyper-local behavior is precisely why a deep, on-the-ground understanding is so essential.

Fair market value is a direct reflection of local supply and demand. National headlines provide context, but the most accurate valuation comes from analyzing recent, comparable sales right in your target area.

Ultimately, your expertise in decoding these complex, local signals is what makes your valuation truly reliable. While a Broker Price Opinion (BPO) can offer a snapshot of value, a comprehensive CMA built on current, local data tells the most accurate and defensible story. You can learn more about how a Broker Price Opinion differs from a CMA in our detailed guide. Mastering this story helps you explain complex market movements to your clients, cementing your role as their indispensable expert.

Explaining Fair Market Value to Your Clients

All the number-crunching in the world won't help if your client doesn't buy into the final price. This is where your analysis meets the real world. The pricing conversation is everything, and it starts with positioning your CMA as the single most reliable picture of their home's value.

When you sit down with them, you're not just dropping a number on the table. You're telling the story of the market right now. Walk them through the comps you chose, one by one. Explain exactly why these specific homes are the best reflection of what a ready, willing, and able buyer will pay today. This builds a rock-solid case for your recommended price range.

Managing Seller Expectations

Let's be honest: one of the toughest parts of the job is dealing with a seller's dream price. Their number is often based on emotional attachment, what a neighbor said their house sold for, or—most commonly—a wildly optimistic online estimate. You have to tackle this directly, armed with data and confidence.

When a client points to a high Zestimate, be ready. You can acknowledge it without validating it. Explain that automated valuation models (AVMs) are a fun starting point, but they’ve never stepped inside their house. They don't know about the new kitchen, the leaky faucet, or the fact that the house next door sold to a cousin for a friendly price.

Talking Point: "I completely see why that online number is exciting. Think of it like a satellite photo of the entire country—it's a very broad view. What I've done here is create a detailed street-level map, focusing only on the homes a potential buyer for your property would be touring this weekend."

This little script does two things: it validates their research so they feel heard, but it quickly pivots to reinforce your value as the boots-on-the-ground expert. Your analysis is based on real-world sales, not algorithms.

Using FMV as a Strategic Tool

Your fair market value analysis isn't just a number for the listing agreement. It’s a powerful tool you can use to win business and get deals done.

- In Listing Presentations: Nothing screams "I know what I'm doing" like a well-researched, professionally presented CMA. It shows sellers you have a real strategy to get their home priced right from the start, which means more money in their pocket and less time sitting on the market.

- During Negotiations: When an offer comes in, your FMV becomes your anchor. If a lowball offer lands in your inbox, you don't have to get emotional. You can simply point back to the hard data in your report to justify your counteroffer.

By mastering how to explain fair market value, you transform from just another agent into a trusted advisor. That’s how you build the kind of confidence that empowers your clients to make smart, profitable decisions from listing to closing.

Fair Market Value: Your Questions Answered

Even after you get the hang of fair market value, you'll find certain questions pop up again and again. Whether they're from clients, other agents, or even just rattling around in your own head, having clear answers ready is key. Let’s tackle some of the most common ones.

Is Fair Market Value the Same as What My House Will Sell For?

Not always, but it's our best-educated guess. Think of fair market value as the target we're aiming for. It’s the most probable price, but the final number can get nudged up or down by a few key factors.

Things like sharp negotiation, the number of buyers competing for the property, and even a particular buyer's personal motivation can push the price one way or the other. In a bidding war, a home will almost certainly sell above its FMV. In a quieter market, you might have to accept a little less. The FMV is our strategic starting line.

Why Is My Property’s Assessed Value So Different From Its Fair Market Value?

This is a classic, and for good reason—it’s confusing! Here’s the simple breakdown: the assessed value exists for one reason only, and that's for the local government to calculate your property taxes. That’s it.

It's usually calculated with a mass appraisal formula, it isn't updated very often, and it almost never reflects what's happening in the real estate market right now. Fair market value is a live snapshot of what a real buyer is willing to pay today, based on what other homes like yours are actually selling for.

If you remember one thing, make it this: Assessed value is for taxing, and fair market value is for transacting. They're two totally different numbers for two totally different purposes.

Do Renovations Always Increase My Home’s Fair Market Value?

This is a big one. While most people assume renovations automatically add value, it's rarely a dollar-for-dollar return. The real impact of an upgrade on your home's FMV comes down to what today's buyers are actually looking for in your neighborhood.

- High-Impact Upgrades: Things that appeal to almost everyone, like modern kitchen and bathroom remodels, a new roof, or energy-efficient windows, tend to give you the most bang for your buck.

- Personalized Upgrades: Super specific projects, like that custom-built home theater or a backyard skate park, might be amazing for you, but they won't appeal to a wide audience. As a result, they often have a much smaller—or even zero—impact on the FMV.

The bottom line is that the smartest renovations are the ones that align with current market demand. A great agent can tell you exactly which projects will make buyers’ eyes light up and which ones you should probably skip.

Nailing the fair market value is the bedrock of a solid listing strategy. With Saleswise, you can build a comprehensive, data-driven Comparative Market Analysis in about 30 seconds. It gives you the evidence to price with confidence, guide your clients effectively, and win more business. Ditch the hours of manual comps and let smart technology deliver the pricing intelligence you need, instantly. Explore Saleswise and start your $1 trial today.